Global Market Trends

The US Bio Based Chemicals Market is also influenced by global market trends that favor sustainable practices. As international regulations tighten around carbon emissions and environmental sustainability, US companies are compelled to adapt to these changes to remain competitive. The global bio-based chemicals market is projected to reach USD 100 billion by 2030, with the US playing a crucial role in this growth. This global perspective encourages local manufacturers to innovate and invest in bio-based solutions, aligning with international standards. The increasing collaboration between US companies and international partners in research and development further enhances the market's potential. As global demand for sustainable products rises, the US Bio Based Chemicals Market is likely to benefit from these trends.

Rising Consumer Awareness

Consumer awareness regarding environmental issues is a crucial driver for the US Bio Based Chemicals Market. As consumers become more informed about the impact of traditional chemicals on health and the environment, there is a growing demand for eco-friendly alternatives. Surveys indicate that over 70% of consumers in the US prefer products made from renewable resources, which has led to an increase in the production of bio-based chemicals. This shift in consumer preference is prompting manufacturers to innovate and develop sustainable products, thereby expanding the market. The increasing availability of bio-based options in various sectors, including personal care and packaging, reflects this trend and underscores the importance of consumer awareness in shaping the industry.

Technological Innovations

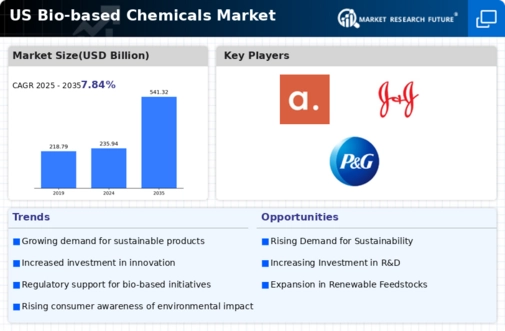

Technological innovations play a vital role in advancing the US Bio Based Chemicals Market. Recent developments in biotechnology and chemical engineering have enabled the efficient production of bio-based chemicals from renewable resources. For instance, advancements in fermentation technology have improved the yield and cost-effectiveness of bio-based production processes. The market is expected to grow at a compound annual growth rate (CAGR) of 12% from 2025 to 2030, largely due to these innovations. Companies are increasingly investing in research and development to enhance production techniques and reduce costs, which is likely to further propel the market. The integration of digital technologies in manufacturing processes also holds the potential to optimize operations and improve sustainability.

Corporate Sustainability Goals

The commitment of corporations to sustainability is a significant driver for the US Bio Based Chemicals Market. Many companies are setting ambitious sustainability goals, aiming to reduce their carbon footprint and transition to renewable resources. This trend is evident in various sectors, including automotive, packaging, and consumer goods, where firms are increasingly adopting bio-based chemicals as part of their product offerings. For example, major brands have pledged to use 100% renewable materials in their products by 2030. This corporate shift not only enhances brand reputation but also aligns with consumer expectations for environmentally responsible products. As more companies embrace sustainability, the demand for bio-based chemicals is likely to rise, further stimulating market growth.

Government Regulations and Incentives

The US Bio Based Chemicals Market is significantly influenced by government regulations and incentives aimed at promoting sustainable practices. The Renewable Fuel Standard (RFS) and the BioPreferred Program are examples of initiatives that encourage the use of bio-based products. These regulations not only provide a framework for the industry but also offer financial incentives for companies that invest in bio-based technologies. As of 2025, the market for bio-based chemicals in the US is projected to reach approximately USD 20 billion, driven by these supportive policies. The government’s commitment to reducing greenhouse gas emissions and promoting renewable resources further enhances the attractiveness of bio-based chemicals, making it a pivotal driver in the industry.