Rising Energy Demand

The increasing energy demand in the US is a pivotal driver for the biomass power market. As the population grows and industrial activities expand, the need for sustainable energy sources intensifies. Biomass power, being renewable, offers a viable solution to meet this demand. In 2025, the US energy consumption is projected to rise by approximately 1.5% annually, with biomass contributing a notable share. This trend indicates a shift towards cleaner energy alternatives, as consumers and businesses alike seek to reduce their carbon footprints. The biomass power market is thus positioned to play a crucial role in addressing this growing energy requirement, potentially leading to increased investments and innovations in biomass technologies.

Supportive Policy Frameworks

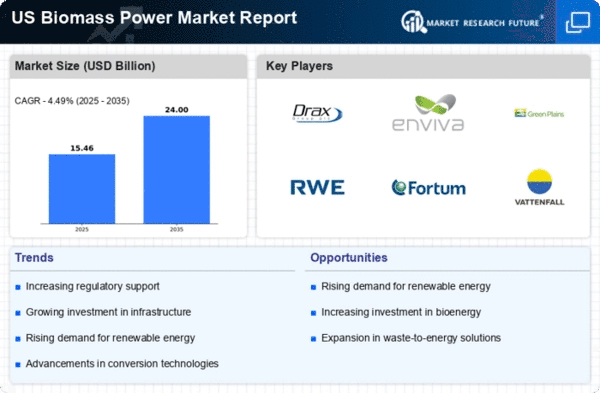

Supportive policy frameworks are crucial for the biomass power market's expansion. Federal and state policies that promote renewable energy development create a conducive environment for biomass projects. Incentives such as tax credits, grants, and subsidies are instrumental in lowering the financial barriers for biomass energy investments. In 2025, it is anticipated that the US will allocate over $1 billion towards renewable energy initiatives, with a significant portion directed towards the biomass power market. This financial support not only encourages new projects but also fosters innovation and research in biomass technologies. As policies evolve to favor renewable energy, the biomass power market is likely to experience accelerated growth and increased market participation.

Environmental Sustainability Initiatives

The emphasis on environmental sustainability is significantly influencing the biomass power market. With climate change concerns at the forefront, there is a strong push for cleaner energy solutions. The US government has set ambitious targets to reduce greenhouse gas emissions by 50% by 2030, which aligns with the objectives of the biomass power market. This commitment fosters a favorable environment for biomass energy projects, as they contribute to carbon neutrality. Furthermore, the market is expected to grow as more states implement renewable portfolio standards, mandating a certain % of energy to come from renewable sources, including biomass. This regulatory landscape encourages investment and development in biomass technologies, enhancing the industry's growth prospects.

Growing Awareness of Energy Independence

The growing awareness of energy independence is emerging as a significant driver for the biomass power market. As the US seeks to reduce its reliance on foreign energy sources, biomass presents a domestic solution that can enhance energy security. The biomass power market is well-positioned to capitalize on this trend, as it utilizes locally sourced materials, thereby supporting local economies and reducing transportation emissions. In 2025, it is projected that biomass could account for approximately 5% of the total energy mix in the US, reflecting a shift towards self-sufficiency in energy production. This focus on energy independence may lead to increased investments in biomass infrastructure and technology, further solidifying its role in the US energy landscape.

Technological Innovations in Biomass Conversion

Technological advancements in biomass conversion processes are driving the growth of the biomass power market. Innovations such as gasification and anaerobic digestion are enhancing the efficiency of biomass energy production. These technologies allow for a broader range of feedstocks to be utilized, thereby increasing the overall biomass supply. In 2025, the efficiency of biomass conversion technologies is expected to improve by up to 20%, making biomass a more competitive energy source. The biomass power market is likely to benefit from these advancements, as they not only reduce production costs but also improve the environmental performance of biomass energy. This technological evolution may attract further investments and research, solidifying the industry's position in the energy sector.