Increased Demand for Energy Efficiency

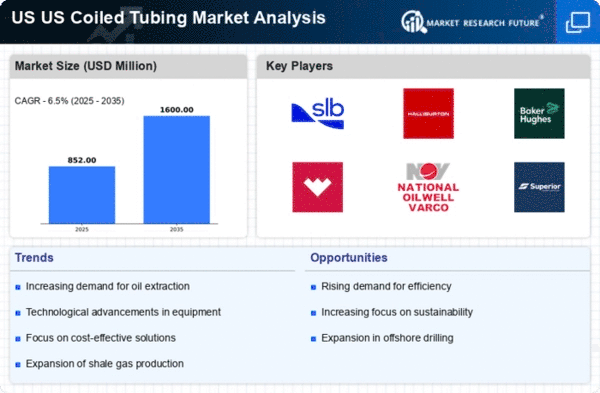

The coiled tubing market experiences a notable surge in demand driven by the increasing emphasis on energy efficiency within the oil and gas sector. Operators are seeking innovative solutions to enhance production while minimizing costs. Coiled tubing technology offers advantages such as reduced operational time and improved wellbore access, which can lead to significant cost savings. In 2025, the market is projected to grow at a CAGR of approximately 5.2%, reflecting the industry's shift towards more efficient extraction methods. This trend indicates that companies are likely to invest in coiled tubing services to optimize their operations, thereby propelling the coiled tubing market forward.

Growing Investment in Oil and Gas Infrastructure

The coiled tubing market benefits from the growing investment in oil and gas infrastructure across the US. As new pipelines, refineries, and processing facilities are developed, the demand for coiled tubing services is expected to rise. Infrastructure projects often require extensive drilling and completion services, where coiled tubing plays a crucial role. The US government has allocated substantial funding for energy infrastructure improvements, with investments projected to exceed $50 billion by 2025. This influx of capital is likely to stimulate demand for coiled tubing services, thereby bolstering the market's growth trajectory.

Expansion of Unconventional Oil and Gas Resources

The exploration and production of unconventional oil and gas resources, such as shale gas and tight oil, significantly influence the coiled tubing market. As operators increasingly tap into these resources, the need for advanced drilling techniques becomes paramount. Coiled tubing services are essential for the efficient completion and maintenance of these wells, which often require specialized techniques. The US shale gas production is expected to reach approximately 100 Bcf/d by 2025, underscoring the critical role of coiled tubing in facilitating this growth. Consequently, the expansion of unconventional resources is likely to drive demand for coiled tubing services, enhancing the market's prospects.

Rising Focus on Well Maintenance and Rehabilitation

The coiled tubing market is significantly influenced by the increasing focus on well maintenance and rehabilitation. As existing wells age, operators are compelled to invest in maintenance to prolong their productive life. Coiled tubing services are particularly effective for interventions such as cleaning, stimulation, and repair, which are essential for maintaining well integrity. In 2025, the market for well maintenance services is anticipated to grow by approximately 4.5%, indicating a robust demand for coiled tubing solutions. This trend suggests that operators are likely to prioritize coiled tubing services as a cost-effective means to enhance the longevity and productivity of their wells.

Technological Innovations in Coiled Tubing Equipment

Technological advancements in coiled tubing equipment play a pivotal role in shaping the coiled tubing market. Innovations such as improved materials, enhanced monitoring systems, and automation are transforming operational efficiency and safety. For instance, the introduction of high-strength alloys and advanced sensors allows for deeper and more complex well interventions. As operators seek to reduce downtime and enhance productivity, the adoption of these technologies is expected to rise. By 2025, the market for advanced coiled tubing equipment could witness a growth rate of around 6%, reflecting the industry's commitment to leveraging technology for improved performance.