Rising Construction Activities

The growth is driven by the increasing number of construction projects across the United States. As urbanization accelerates, the demand for residential, commercial, and infrastructure development rises. According to recent data, the construction industry in the US is projected to reach a value of approximately $1.8 trillion by 2026. This surge in construction activities necessitates the use of advanced tools, including construction lasers, to ensure precision and efficiency. The integration of lasers in construction processes enhances accuracy in measurements and layout, thereby reducing material waste and project timelines. Consequently, the rising construction activities are a significant driver for the construction lasers market, as contractors seek reliable solutions to meet the growing demands of the industry.

Increased Focus on Safety Standards

The construction lasers market is positively influenced by the heightened emphasis on safety standards within the construction industry. Regulatory bodies and organizations are increasingly mandating the use of advanced technologies that enhance safety on job sites. Construction lasers provide precise measurements, reducing the likelihood of errors that could lead to accidents or structural failures. As safety regulations become more stringent, contractors are compelled to adopt tools that not only improve accuracy but also ensure compliance with safety protocols. This trend is likely to drive the demand for construction lasers, as companies prioritize worker safety and operational efficiency. The construction lasers market stands to benefit from this shift towards safer construction practices, as more firms invest in technology that aligns with regulatory requirements.

Growing Demand for Renovation Projects

The construction lasers market is benefiting from the growing trend of renovation and remodeling projects across the United States. As homeowners and businesses seek to upgrade their spaces, the need for accurate measurements and layouts becomes paramount. Construction lasers provide the precision required for these projects, ensuring that renovations are executed flawlessly. The renovation market is expected to reach a valuation of $400 billion by 2027, indicating a robust demand for tools that enhance accuracy and efficiency. This trend is likely to drive the construction lasers market, as contractors and DIY enthusiasts alike recognize the advantages of using lasers for their renovation endeavors. The increasing focus on home improvement and commercial upgrades is a significant factor contributing to the growth of the construction lasers market.

Expansion of Smart Construction Practices

The construction lasers market is poised for growth due to the expansion of smart construction practices that leverage automation and data analytics. As the industry moves towards more intelligent solutions, the demand for construction lasers that integrate with smart technologies is likely to increase. These lasers not only provide precise measurements but also connect with other smart devices to enhance project efficiency. The trend towards smart construction is supported by the increasing adoption of Internet of Things (IoT) technologies, which facilitate real-time monitoring and data sharing. This shift is expected to drive the construction lasers market, as companies seek to optimize their operations and improve project outcomes. The potential for enhanced productivity and reduced costs associated with smart construction practices positions the construction lasers market favorably for future growth.

Technological Integration in Construction

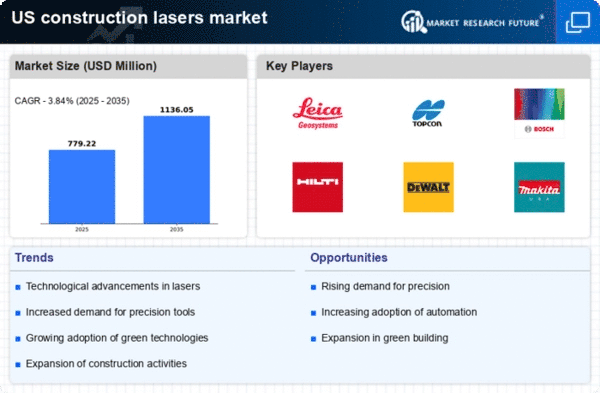

The construction lasers market is propelled by integrating advanced technologies like Building Information Modeling (BIM) and Geographic Information Systems (GIS) into construction processes. These technologies facilitate enhanced planning, design, and execution of construction projects. The incorporation of construction lasers into these systems allows for real-time data collection and analysis, improving overall project management. As the construction industry increasingly adopts digital solutions, the demand for construction lasers is expected to rise. The market is projected to grow at a CAGR of approximately 7% from 2025 to 2030, driven by the need for precision and efficiency in construction practices. This technological integration is a key driver for the construction lasers market, as it aligns with the industry's shift towards more sophisticated methodologies.