Rising Prevalence of Diabetes

The increasing incidence of diabetes in the US is a primary driver for the diabetic retinopathy market. According to the Centers for Disease Control and Prevention (CDC), approximately 34.2 million people in the US have diabetes, which translates to about 10.5% of the population. This growing diabetic population is likely to lead to a corresponding rise in diabetic retinopathy cases, as the condition is a common complication of diabetes. As awareness of the disease and its complications increases, healthcare providers are expected to focus more on screening and treatment options, thereby expanding the diabetic retinopathy market. Furthermore, the economic burden associated with diabetes management, estimated at $327 billion annually, underscores the need for effective interventions in the diabetic retinopathy market.

Increased Awareness and Education

There is a growing emphasis on awareness and education regarding diabetic retinopathy, which serves as a crucial driver for the diabetic retinopathy market. Public health campaigns and initiatives by organizations such as the American Diabetes Association aim to educate both patients and healthcare professionals about the risks associated with diabetic retinopathy. This heightened awareness is likely to lead to earlier diagnosis and treatment, ultimately improving patient outcomes. Furthermore, educational programs targeting at-risk populations can enhance understanding of the importance of regular eye examinations. As more individuals become informed about the potential complications of diabetes, the demand for screening and treatment services in the diabetic retinopathy market is expected to rise.

Advancements in Treatment Modalities

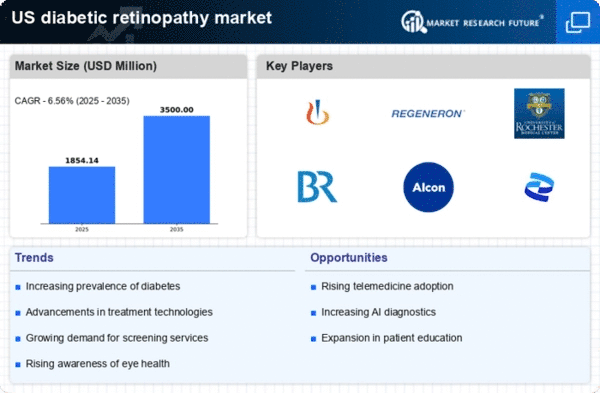

Innovations in treatment options for diabetic retinopathy are significantly influencing the diabetic retinopathy market. Recent developments in pharmacotherapy, including anti-VEGF (vascular endothelial growth factor) agents, have shown promising results in managing the disease. The introduction of these therapies has the potential to improve patient outcomes and reduce the risk of vision loss. Additionally, laser treatments and surgical interventions continue to evolve, offering more effective solutions for patients. The market for these advanced treatments is projected to grow, with estimates suggesting a compound annual growth rate (CAGR) of around 6.5% over the next several years. As healthcare providers adopt these new modalities, the diabetic retinopathy market is likely to expand, driven by the demand for improved therapeutic options.

Integration of Digital Health Solutions

The integration of digital health solutions into the management of diabetic retinopathy is emerging as a key driver for the diabetic retinopathy market. Telehealth platforms and mobile health applications are increasingly being utilized to facilitate remote monitoring and consultations for patients with diabetes. These technologies enable healthcare providers to track disease progression and offer timely interventions, which can be particularly beneficial for those in underserved areas. The convenience and accessibility of digital health solutions may lead to increased patient engagement and adherence to treatment plans. As the adoption of these technologies continues to grow, the diabetic retinopathy market is likely to benefit from enhanced patient management and improved clinical outcomes.

Regulatory Support for Innovative Therapies

Regulatory bodies in the US are increasingly supportive of innovative therapies for diabetic retinopathy, which is likely to bolster the diabetic retinopathy market. The Food and Drug Administration (FDA) has streamlined the approval process for new treatments, facilitating quicker access to novel therapies for patients. This regulatory environment encourages pharmaceutical companies to invest in research and development, leading to a wider array of treatment options. The approval of new drugs and technologies can stimulate market growth, as healthcare providers are more inclined to adopt effective solutions that have received regulatory endorsement. Consequently, the diabetic retinopathy market may experience significant expansion as new therapies become available to clinicians and patients.