Advancements in Sensor Technology

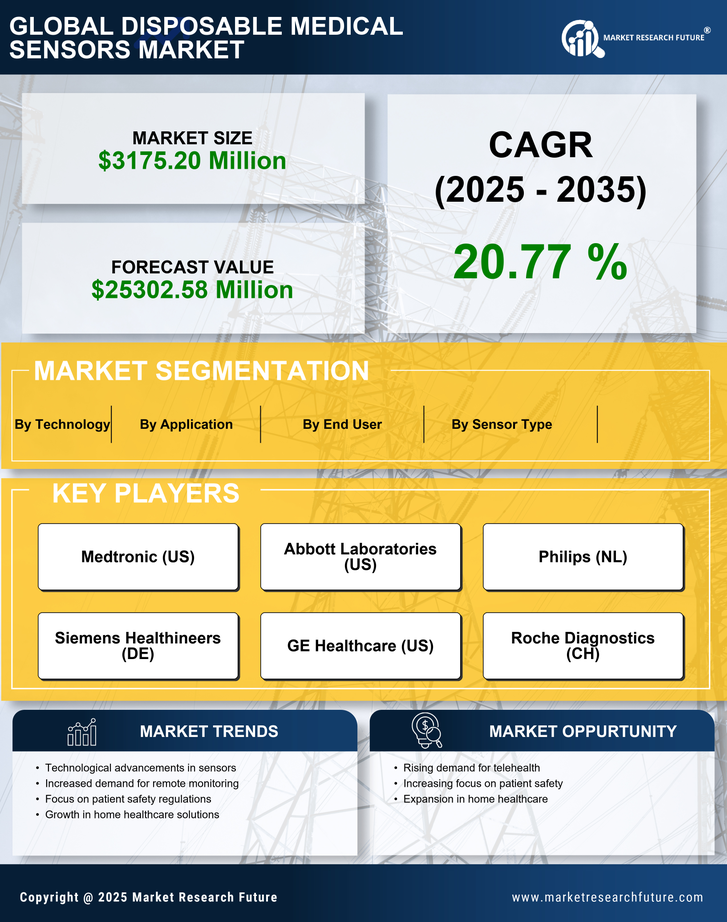

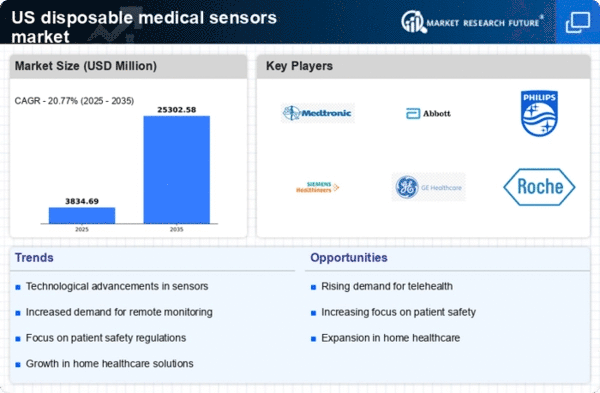

Technological innovations in sensor design and functionality are significantly impacting the disposable medical-sensors market. The development of more accurate, reliable, and miniaturized sensors has expanded their applications across various medical fields. For instance, advancements in biosensor technology have enabled the creation of sensors that can monitor glucose levels, heart rate, and other vital parameters with remarkable precision. The market for biosensors alone is anticipated to reach $30 billion by 2026, indicating a robust growth trajectory. These advancements not only enhance the performance of disposable medical sensors but also broaden their usability in diverse healthcare settings. As healthcare providers increasingly adopt these advanced sensors for diagnostics and monitoring, the disposable medical-sensors market is poised for substantial growth, driven by the demand for innovative and effective medical solutions.

Increased Focus on Infection Control

Infection control remains a critical concern in healthcare settings, significantly influencing the disposable medical-sensors market. The heightened awareness of hygiene and the need to prevent hospital-acquired infections have led to a growing preference for single-use medical devices. Disposable medical sensors, designed for one-time use, mitigate the risk of cross-contamination and are increasingly favored by healthcare providers. Data suggests that the market for infection control products is expected to expand by over 20% in the coming years, reflecting the urgent need for effective solutions. This trend underscores the importance of disposable medical sensors in maintaining patient safety and enhancing overall healthcare quality. As hospitals and clinics prioritize infection prevention strategies, the demand for disposable medical sensors is likely to see a corresponding increase, further driving market growth.

Rising Demand for Remote Patient Monitoring

The increasing emphasis on remote patient monitoring is a pivotal driver for the disposable medical-sensors market. As healthcare providers seek to enhance patient care while minimizing hospital visits, the demand for disposable sensors that can monitor vital signs remotely has surged. According to recent data, the market for remote patient monitoring devices is projected to grow at a CAGR of approximately 25% over the next five years. This trend indicates a significant shift towards home healthcare solutions, where disposable medical sensors play a crucial role in providing real-time data to healthcare professionals. The convenience and efficiency offered by these sensors are likely to drive their adoption, thereby propelling the growth of the disposable medical-sensors market. Furthermore, the integration of these sensors with telehealth platforms enhances their utility, making them indispensable in modern healthcare delivery.

Regulatory Support for Innovative Medical Devices

Regulatory frameworks in the US are evolving to support the introduction of innovative medical devices, including disposable medical sensors. The FDA has implemented streamlined processes for the approval of new medical technologies, which encourages manufacturers to invest in research and development. This regulatory support is crucial for fostering innovation within the disposable medical-sensors market. As a result, companies are more likely to introduce cutting-edge products that meet the growing demands of healthcare providers. The FDA's initiatives to expedite the review process for breakthrough devices could potentially lead to a surge in new disposable medical sensors entering the market. This favorable regulatory environment is expected to stimulate competition and drive advancements in sensor technology, ultimately benefiting the disposable medical-sensors market.

Growing Aging Population and Chronic Disease Prevalence

The demographic shift towards an aging population in the US is a significant driver for the disposable medical-sensors market. As the elderly population continues to grow, the prevalence of chronic diseases such as diabetes, cardiovascular conditions, and respiratory disorders is also on the rise. This demographic trend necessitates continuous monitoring of health conditions, thereby increasing the demand for disposable medical sensors. According to projections, the number of individuals aged 65 and older is expected to reach 80 million by 2040, highlighting the urgent need for effective monitoring solutions. Disposable medical sensors provide a practical approach to managing chronic diseases, allowing for timely interventions and improved patient outcomes. Consequently, the growing aging population and the associated rise in chronic disease prevalence are likely to drive the expansion of the disposable medical-sensors market.