Rising Crime Rates

The increasing incidence of crime in the United States has a direct impact on the The increasing incidence of crime in the United States has a direct impact on the market for DNA forensics.. Law enforcement agencies are under pressure to solve cases efficiently, leading to a heightened demand for advanced forensic technologies. In 2023, the FBI reported a 5% rise in violent crime, prompting a need for more robust forensic solutions. This trend suggests that as crime rates continue to escalate, the dna forensics market will likely experience significant growth. The integration of DNA analysis in criminal investigations not only aids in solving cases but also enhances the overall efficacy of the justice system. Consequently, the rising crime rates are a pivotal driver for the dna forensics market, as they necessitate the adoption of innovative forensic methodologies to ensure public safety.

Legal Reforms and Standards

Recent legal reforms and the establishment of stringent standards for forensic evidence are shaping the Recent legal reforms and the establishment of stringent standards for forensic evidence are shaping the market for DNA forensics.. The introduction of new regulations aimed at ensuring the integrity and reliability of forensic practices has created a more structured environment for the application of DNA analysis. In 2023, the National Institute of Standards and Technology (NIST) released updated guidelines for forensic laboratories, which are expected to enhance the quality of DNA testing. These reforms not only promote public trust in forensic science but also encourage laboratories to adopt best practices, thereby expanding the dna forensics market. As legal frameworks evolve, the demand for compliant and high-quality forensic services is likely to increase, further driving market growth.

Public Awareness and Advocacy

There is a growing public awareness regarding the importance of forensic science in the justice system, which is positively influencing the There is a growing public awareness regarding the importance of forensic science in the justice system, which is positively influencing the market for DNA forensics.. Advocacy groups and educational initiatives are emphasizing the role of DNA evidence in exonerating the innocent and convicting the guilty. This heightened awareness is leading to increased funding for forensic programs and research, as stakeholders recognize the value of accurate forensic analysis. In 2025, it is estimated that public funding for forensic science will increase by 15%, further bolstering the dna forensics market. As the public becomes more informed about the capabilities and limitations of DNA evidence, the demand for reliable forensic services is likely to rise, driving market growth.

Collaboration Between Agencies

The collaboration between various law enforcement agencies and forensic laboratories is emerging as a crucial driver for the The collaboration between various law enforcement agencies and forensic laboratories is emerging as a crucial driver for the market for DNA forensics.. Inter-agency partnerships facilitate the sharing of resources, expertise, and data, leading to more effective investigations. In 2025, it is anticipated that collaborative initiatives will increase by 20%, enhancing the overall efficiency of forensic operations. This trend not only improves case resolution rates but also fosters innovation in forensic methodologies. As agencies work together to tackle complex cases, the demand for advanced DNA analysis tools and services is expected to rise, thereby propelling the growth of the dna forensics market. The synergy created through collaboration is likely to yield significant advancements in forensic science.

Technological Integration in Law Enforcement

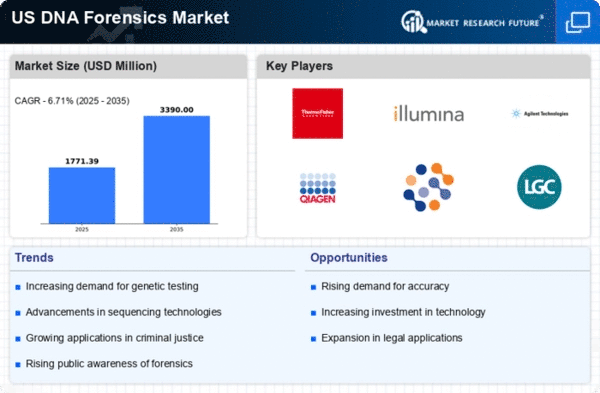

The adoption of cutting-edge technologies within law enforcement agencies is transforming the The adoption of cutting-edge technologies within law enforcement agencies is transforming the market for DNA forensics.. Innovations such as next-generation sequencing (NGS) and automated DNA analysis systems are becoming increasingly prevalent. These advancements enable faster and more accurate results, which are crucial for timely investigations. In 2024, it is projected that the market for DNA analysis technology will reach $1.5 billion, reflecting a compound annual growth rate (CAGR) of 10%. This technological integration not only streamlines forensic processes but also enhances the reliability of evidence presented in court. As law enforcement agencies continue to embrace these technologies, the dna forensics market is poised for substantial growth, driven by the need for efficiency and accuracy in criminal investigations.