Policy and Incentive Frameworks

The energy storage market is being propelled by favorable policy and incentive frameworks established by federal and state governments. Various initiatives, such as tax credits and grants, are designed to encourage the adoption of energy storage technologies. In 2025, several states have implemented policies that support energy storage deployment, including mandates for utilities to invest in storage solutions. These policies not only enhance the economic viability of energy storage projects but also promote innovation within the industry. As these frameworks evolve, they are expected to further stimulate growth in the energy storage market, creating a more favorable environment for investment and development.

Rising Electric Vehicle Adoption

The surge in electric vehicle (EV) adoption is influencing the energy storage market significantly. As of 2025, EV sales in the US have reached approximately 20% of total vehicle sales, creating a parallel demand for energy storage solutions. EVs require robust charging infrastructure, which often incorporates energy storage systems to manage peak demand and provide grid services. This interconnection between the EV market and energy storage market suggests a symbiotic relationship, where advancements in one sector can bolster the other. The energy storage market is likely to see increased growth as the EV market expands, driven by consumer preferences for sustainable transportation.

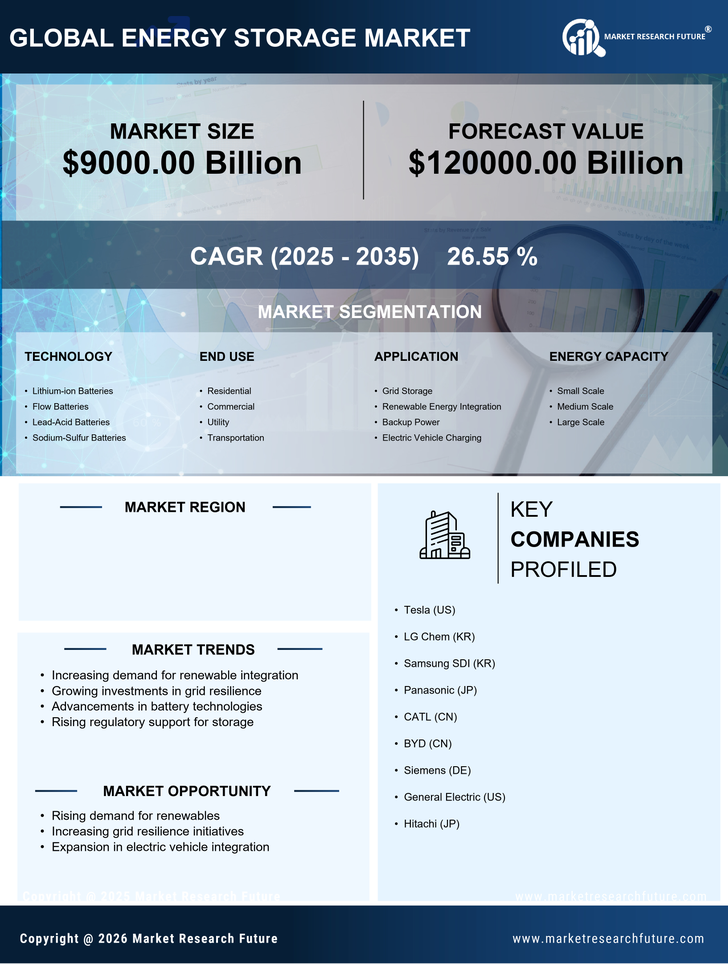

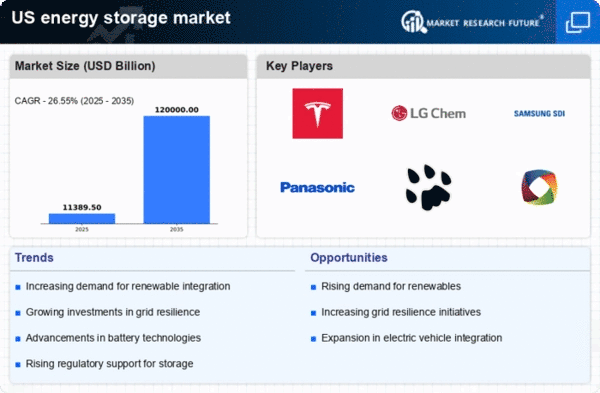

Growing Demand for Renewable Energy

The increasing demand for renewable energy sources in the US is a primary driver for the energy storage market. As more states implement renewable portfolio standards, the need for energy storage solutions becomes critical to balance supply and demand. In 2025, renewable energy accounted for approximately 25% of total electricity generation in the US, with projections suggesting this could rise to 50% by 2030. Energy storage systems are essential for integrating intermittent renewable sources like solar and wind, ensuring grid stability and reliability. This trend indicates a robust growth trajectory for the energy storage market, as utilities and independent power producers seek to enhance their capabilities to store excess energy generated during peak production times.

Increased Investment in Infrastructure

Investment in energy infrastructure is a crucial driver for the energy storage market. The US government and private sector are allocating substantial funds to modernize the electrical grid, with an estimated $100 billion earmarked for infrastructure improvements over the next decade. This investment includes the integration of energy storage systems to enhance grid reliability and efficiency. As utilities upgrade their infrastructure, the demand for energy storage solutions is likely to increase, providing opportunities for market expansion. The energy storage market stands to benefit from these infrastructure developments, as they create a conducive environment for the deployment of advanced storage technologies.

Declining Costs of Energy Storage Technologies

The energy storage market is experiencing a significant transformation due to the declining costs of storage technologies, particularly lithium-ion batteries. The average cost of lithium-ion battery systems has decreased by over 80% since 2010, making energy storage solutions more accessible for both residential and commercial applications. This trend is likely to continue, with further advancements in battery technology and manufacturing processes. As costs decrease, the adoption of energy storage systems is expected to rise, facilitating the integration of renewable energy sources and enhancing grid resilience. The energy storage market is thus positioned for substantial growth, driven by the economic feasibility of these technologies.