Expansion of End-Use Industries

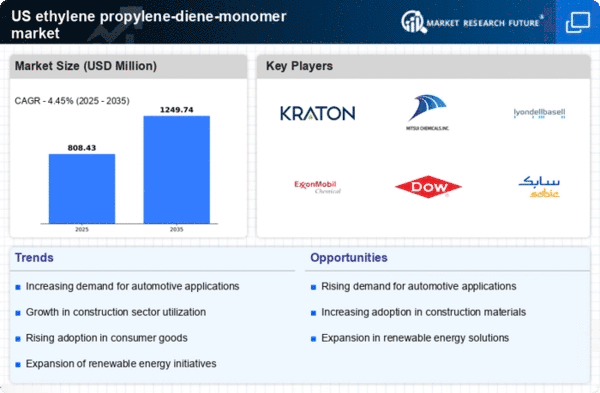

The expansion of various end-use industries is a pivotal driver for the US Ethylene Propylene Diene Monomer Market (EPDM) Market Overview Industry. Industries such as construction, automotive, and consumer goods are increasingly utilizing EPDM for its versatile properties. The growth in these sectors is expected to create new opportunities for EPDM applications, particularly in areas like roofing, automotive parts, and industrial components. As these end-use industries continue to expand, the demand for EPDM is likely to increase, thereby positively impacting the overall market landscape and fostering innovation in product development.

Growing Focus on Sustainability

The US Ethylene Propylene Diene Monomer Market (EPDM) Market Overview Industry is increasingly influenced by sustainability initiatives. As industries strive to reduce their environmental footprint, the demand for eco-friendly materials is on the rise. EPDM, being a recyclable material, aligns well with these sustainability goals. The construction and automotive sectors are particularly focused on incorporating sustainable practices, which may lead to a higher adoption of EPDM products. In 2025, it is anticipated that the market for sustainable building materials will grow significantly, potentially enhancing the demand for EPDM as a preferred choice for environmentally conscious projects.

Rising Demand in Construction Sector

The US Ethylene Propylene Diene Monomer Market (EPDM) Overview Industry is experiencing a notable increase in demand driven by the construction sector. EPDM is widely utilized in roofing membranes, waterproofing, and other construction applications due to its excellent weather resistance and durability. The construction industry in the United States has shown robust growth, with investments in both residential and commercial projects. In 2025, the construction spending is projected to reach approximately 1.8 trillion USD, which could further bolster the demand for EPDM products. This trend suggests that as construction activities expand, the need for high-performance materials like EPDM will likely rise, thereby enhancing the market landscape.

Technological Innovations in EPDM Production

Technological advancements in the production of Ethylene Propylene Diene Monomer (EPDM) are playing a crucial role in shaping the US EPDM Market Overview Industry. Innovations such as improved polymerization techniques and enhanced processing methods are leading to higher quality products with better performance characteristics. These advancements not only increase production efficiency but also reduce costs, making EPDM more accessible to various industries. As manufacturers adopt these technologies, the market is expected to witness a surge in the availability of high-performance EPDM products, which could attract new applications and expand market reach.

Increased Adoption in Automotive Applications

The automotive sector is a significant driver for the US Ethylene Propylene Diene Monomer Market (EPDM) Market Overview Industry. EPDM is increasingly being used in automotive components such as seals, gaskets, and hoses due to its superior resistance to heat, ozone, and weathering. The automotive industry in the United States is projected to grow steadily, with an expected production of over 12 million vehicles in 2025. This growth indicates a rising demand for EPDM materials, as manufacturers seek to enhance vehicle performance and longevity. Consequently, the integration of EPDM in automotive applications is likely to contribute positively to the overall market dynamics.