Surge in Consumer Electronics

The GaAs wafer market is experiencing a notable surge in demand driven by the increasing production of consumer electronics. As devices such as smartphones, tablets, and laptops become more prevalent, the need for high-performance components is paramount. GaAs wafers, known for their superior efficiency and performance in high-frequency applications, are becoming essential in the manufacturing of these devices. In 2025, the consumer electronics sector is projected to contribute approximately $200 billion to the overall semiconductor market, with GaAs wafers playing a critical role in this growth. This trend indicates a robust future for the gaas wafer market, as manufacturers seek to enhance device capabilities while maintaining compact sizes and energy efficiency.

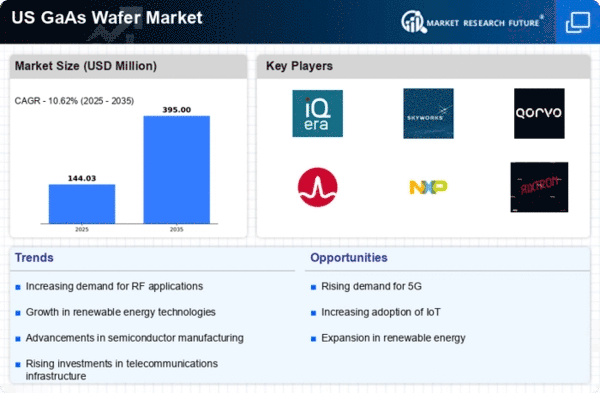

Expansion of 5G Infrastructure

The ongoing expansion of 5G infrastructure in the US is significantly impacting the gaas wafer market. As telecommunications companies invest heavily in upgrading their networks, the demand for high-frequency components is surging. GaAs wafers are particularly suited for 5G applications due to their ability to operate at higher frequencies with lower power consumption. It is estimated that the 5G market will reach $300 billion by 2025, with GaAs technology being a key enabler of this transition. This growth presents a substantial opportunity for the gaas wafer market, as it aligns with the increasing need for faster and more reliable communication technologies.

Advancements in Aerospace and Defense

The aerospace and defense sectors are increasingly adopting GaAs technology, which is driving growth in the gaas wafer market. GaAs wafers are utilized in various applications, including satellite communications, radar systems, and electronic warfare. The US government is projected to allocate over $700 billion to defense spending in 2025, with a significant portion directed towards advanced technologies that enhance operational capabilities. This investment is likely to bolster the demand for GaAs wafers, as they provide the necessary performance and reliability required in critical defense applications. The GaAs wafer market is thus positioned to benefit from this upward trend in defense-related expenditures.

Growth in Renewable Energy Technologies

The shift towards renewable energy technologies is influencing the gaas wafer market positively. GaAs wafers are increasingly being used in solar cells and other renewable energy applications due to their high efficiency and performance. The US solar market is expected to grow to $30 billion by 2025, with GaAs technology playing a pivotal role in enhancing energy conversion efficiencies. This trend suggests that the GaAs wafer market could see a substantial increase in demand as manufacturers seek to develop more efficient solar panels and energy systems. The integration of GaAs technology in renewable energy solutions indicates a promising future for the market.

Emergence of Internet of Things (IoT) Devices

The rise of Internet of Things (IoT) devices is creating new opportunities for the gaas wafer market. As more devices become interconnected, the demand for efficient and high-performance components is escalating. GaAs wafers are particularly advantageous in IoT applications due to their ability to support high-frequency operations while minimizing power consumption. The IoT market in the US is projected to reach $1 trillion by 2025, with GaAs technology likely to play a crucial role in the development of smart devices and systems. This growth in IoT applications suggests a favorable outlook for the gaas wafer market, as manufacturers adapt to meet the evolving needs of this expanding sector.