Growing Awareness and Acceptance

Public awareness and acceptance of gene therapy are on the rise, contributing positively to the gene therapy market. Educational campaigns and success stories of patients benefiting from gene therapies are helping to demystify these treatments. Surveys indicate that over 70% of the US population is now aware of gene therapy and its potential benefits. This growing acceptance is likely to lead to increased demand for gene therapies, as patients and healthcare providers become more open to exploring these innovative options. The gene therapy market stands to gain from this shift in perception, as it encourages investment and research into new therapeutic avenues.

Increased Funding and Investment

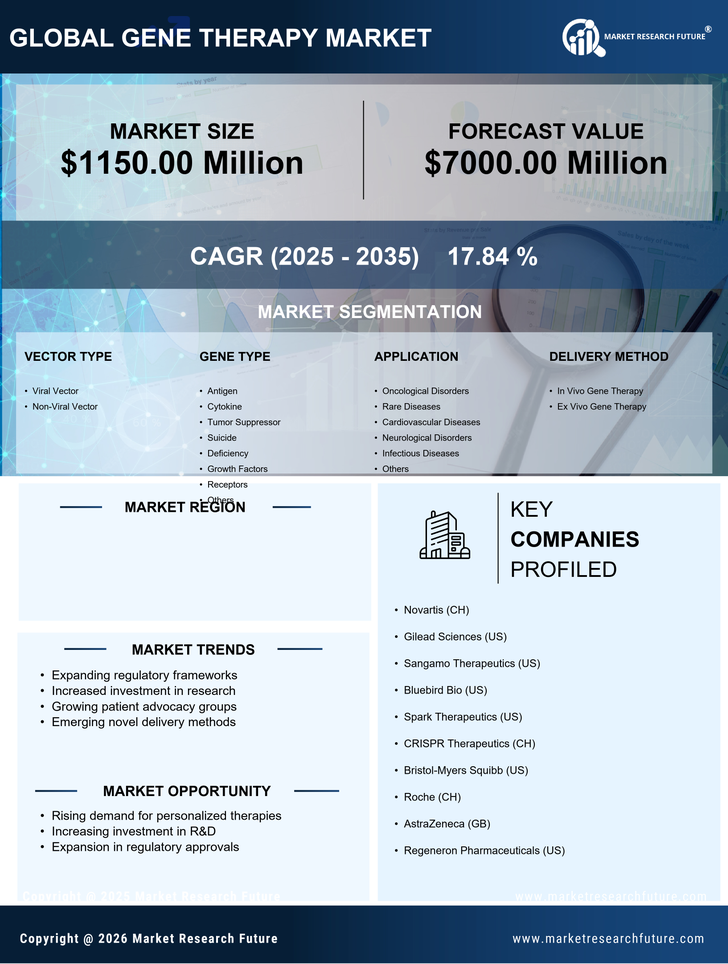

The gene therapy market is experiencing a surge in funding and investment from both public and private sectors. Venture capital investments in biotech firms focused on gene therapy have increased significantly, with estimates suggesting a rise of over 30% in the last few years. This influx of capital is facilitating the development of new therapies and accelerating clinical trials. Additionally, government initiatives aimed at promoting biotechnology research are further bolstering the market. The gene therapy market is thus likely to see a proliferation of novel therapies entering the market, driven by this financial support and the urgency to address unmet medical needs.

Rising Prevalence of Genetic Disorders

The increasing incidence of genetic disorders in the US is a primary driver for the gene therapy market. Conditions such as cystic fibrosis, hemophilia, and muscular dystrophy are becoming more prevalent, necessitating innovative treatment options. According to the National Institutes of Health, approximately 1 in 10 individuals in the US is affected by a genetic disorder, which translates to millions of potential patients. This growing patient population is likely to stimulate demand for gene therapies, as they offer the potential for curative treatments rather than lifelong management. The gene therapy market is thus positioned to expand significantly as healthcare providers seek effective solutions to address these complex conditions.

Advancements in Gene Editing Technologies

Recent breakthroughs in gene editing technologies, particularly CRISPR and TALEN, are propelling the gene therapy market forward. These technologies enable precise modifications to the genome, allowing for targeted therapies that can correct genetic defects at their source. The market for gene editing is projected to reach $10 billion by 2026, indicating robust growth potential. As these technologies become more refined and accessible, they are likely to enhance the efficacy and safety of gene therapies. Consequently, the gene therapy market is expected to benefit from the integration of these advanced techniques, leading to innovative treatment options that could transform patient outcomes.

Regulatory Support and Streamlined Approval Processes

The regulatory landscape for gene therapies in the US is evolving, with agencies like the FDA implementing more streamlined approval processes. This regulatory support is crucial for the gene therapy market, as it reduces the time and cost associated with bringing new therapies to market. The FDA has introduced initiatives such as the Regenerative Medicine Advanced Therapy designation, which expedites the review of promising gene therapies. As a result, the gene therapy market is likely to see an increase in the number of approved therapies, fostering innovation and competition within the sector.