Rising Demand for Enhanced Security

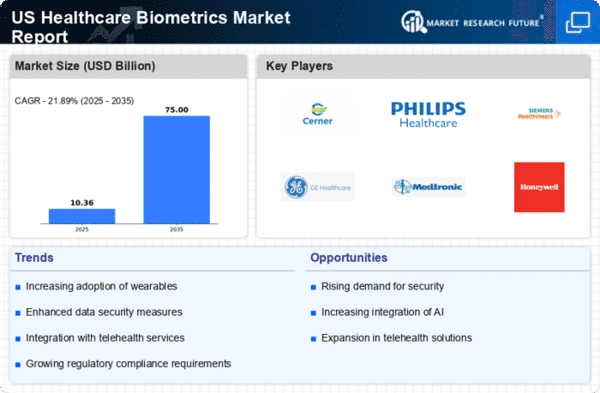

The healthcare biometrics market is experiencing a notable surge in demand for enhanced security measures. As healthcare organizations increasingly prioritize patient data protection, biometric authentication systems are being adopted to mitigate risks associated with data breaches. In 2025, it is estimated that the market for biometric solutions in healthcare could reach approximately $3 billion, reflecting a compound annual growth rate (CAGR) of around 20%. This heightened focus on security is driven by the need to comply with regulations such as HIPAA, which mandates stringent safeguards for patient information. Consequently, the healthcare biometrics market is likely to expand as organizations seek to implement advanced security protocols that not only protect sensitive data but also enhance patient trust and satisfaction.

Growing Emphasis on Patient Experience

The healthcare biometrics market is increasingly influenced by a growing emphasis on patient experience. Healthcare providers are recognizing that streamlined processes can significantly enhance patient satisfaction. Biometric authentication systems reduce wait times and simplify patient check-ins, leading to a more efficient healthcare delivery model. In 2025, it is anticipated that the market will witness a growth rate of approximately 18%, driven by the need for improved patient interactions. By leveraging biometric technologies, healthcare organizations can create a more personalized experience, which is likely to foster patient loyalty and improve overall healthcare outcomes.

Regulatory Support for Biometric Implementation

Regulatory support is emerging as a crucial driver for the healthcare biometrics market. Government initiatives aimed at promoting the adoption of biometric technologies in healthcare are gaining momentum. For instance, various federal agencies are advocating for the use of biometrics to enhance security and streamline processes within healthcare systems. This regulatory backing is expected to facilitate investments in biometric solutions, with projections indicating a market growth of around 15% by 2025. As healthcare organizations align their operations with regulatory standards, the adoption of biometric systems is likely to accelerate, further solidifying their role in safeguarding patient information.

Technological Advancements in Biometric Solutions

Technological advancements are playing a pivotal role in shaping the healthcare biometrics market. Innovations in fingerprint recognition, facial recognition, and iris scanning technologies are making biometric systems more accurate and user-friendly. For instance, the integration of artificial intelligence (AI) and machine learning algorithms is enhancing the efficiency of biometric authentication processes. As of 2025, the market is projected to grow significantly, with estimates suggesting a valuation of around $3.5 billion. These advancements not only improve the reliability of biometric systems but also facilitate seamless integration with existing healthcare IT infrastructures, thereby driving adoption rates across various healthcare settings.

Increased Investment in Healthcare IT Infrastructure

The healthcare biometrics market is benefiting from increased investment in healthcare IT infrastructure. As healthcare organizations strive to modernize their systems, there is a growing recognition of the importance of integrating biometric solutions into their IT frameworks. Investments in electronic health records (EHR) and other digital health technologies are creating opportunities for the deployment of biometric authentication systems. By 2025, the market is projected to reach approximately $4 billion, driven by these investments. This trend indicates a shift towards more secure and efficient healthcare delivery models, where biometric technologies play a central role in enhancing operational efficiency and patient safety.