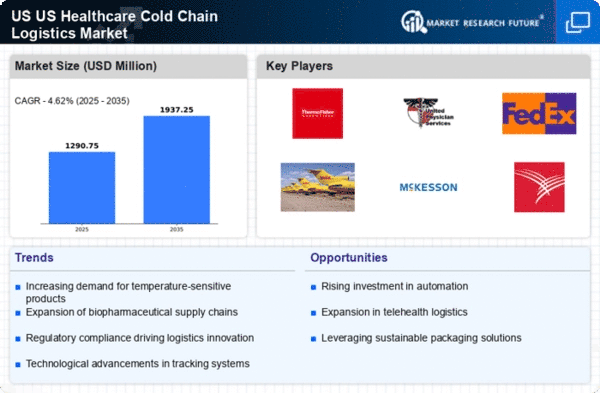

Expansion of E-commerce in Healthcare

The expansion of e-commerce within the healthcare sector is significantly impacting the US Healthcare Cold Chain Logistics Market. As more healthcare products, including pharmaceuticals and medical devices, are sold online, the demand for efficient cold chain logistics solutions is increasing. E-commerce platforms require logistics providers to ensure that temperature-sensitive products are delivered promptly and in optimal condition. Market analysis suggests that the e-commerce healthcare market is projected to grow at a CAGR of over 10% in the next few years, necessitating the development of specialized cold chain logistics strategies. This growth presents opportunities for logistics companies to innovate and enhance their service offerings, thereby positioning themselves as leaders in the evolving landscape of healthcare e-commerce.

Growing Demand for Biopharmaceuticals

The increasing demand for biopharmaceuticals is significantly influencing the US Healthcare Cold Chain Logistics Market. As the biopharmaceutical sector expands, driven by advancements in personalized medicine and biologics, the need for specialized cold chain logistics solutions becomes more pronounced. Biopharmaceuticals often require strict temperature control during transportation and storage, necessitating robust cold chain systems. Market data indicates that the biopharmaceutical market is expected to grow at a CAGR of over 8% in the coming years, further amplifying the demand for efficient cold chain logistics. This growth presents opportunities for logistics providers to develop tailored solutions that cater to the unique requirements of biopharmaceutical products, thereby enhancing their market positioning and driving revenue growth.

Rising Consumer Awareness and Expectations

Rising consumer awareness regarding the importance of product integrity is shaping the US Healthcare Cold Chain Logistics Market. As patients and healthcare providers become more informed about the implications of temperature fluctuations on product efficacy, there is a growing expectation for transparency and reliability in the supply chain. This trend is prompting logistics companies to adopt more stringent monitoring practices and provide detailed reporting on temperature conditions throughout the distribution process. The demand for accountability is likely to drive investments in advanced tracking technologies and data analytics, enabling logistics providers to meet consumer expectations effectively. Consequently, this heightened awareness is expected to contribute to the overall growth of the cold chain logistics market, as stakeholders prioritize partnerships with providers that can demonstrate a commitment to quality and reliability.

Regulatory Compliance and Quality Assurance

Regulatory compliance plays a pivotal role in shaping the US Healthcare Cold Chain Logistics Market. Stringent regulations imposed by agencies such as the FDA and CDC necessitate that healthcare logistics providers adhere to rigorous quality assurance protocols. These regulations are designed to ensure the safety and efficacy of temperature-sensitive products, including vaccines and biologics. As a result, logistics companies are investing heavily in compliance training and quality management systems to meet these standards. The market is projected to grow as healthcare organizations prioritize partnerships with logistics providers that demonstrate a commitment to regulatory compliance. In fact, adherence to these regulations is expected to become a key differentiator in the competitive landscape, influencing procurement decisions and fostering long-term relationships between healthcare providers and logistics firms.

Technological Advancements in Cold Chain Solutions

The US Healthcare Cold Chain Logistics Market is experiencing a transformative phase due to rapid technological advancements. Innovations such as IoT-enabled temperature monitoring systems and automated storage solutions are enhancing the efficiency and reliability of cold chain logistics. These technologies facilitate real-time tracking of temperature-sensitive products, ensuring compliance with stringent regulatory standards. According to recent data, the integration of advanced technologies is projected to reduce operational costs by up to 20% while improving service delivery. Furthermore, the adoption of blockchain technology is anticipated to enhance traceability and transparency in the supply chain, thereby bolstering consumer confidence. As healthcare providers increasingly rely on these technologies, the market is likely to witness substantial growth, driven by the need for improved logistics solutions that can accommodate the complexities of modern healthcare demands.