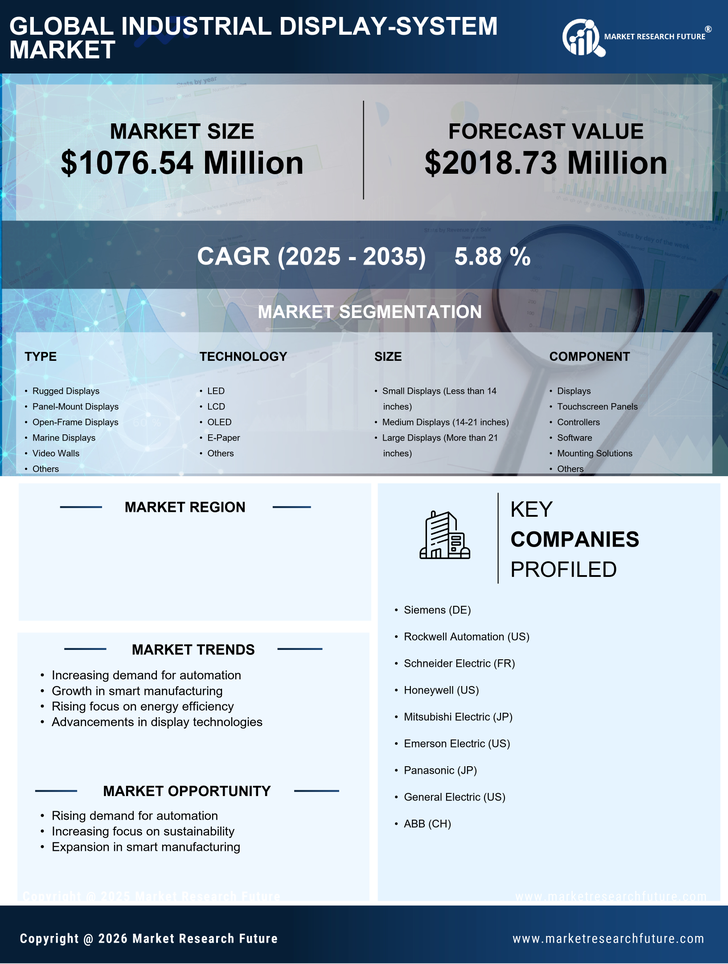

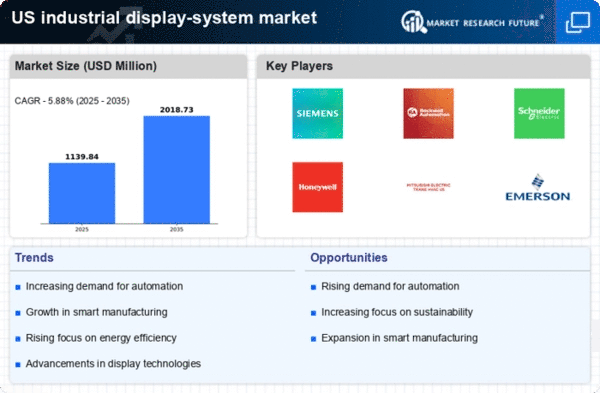

Rising Demand for Automation

The industrial display-system market experiences a notable surge in demand driven by the increasing adoption of automation across various sectors. Industries such as manufacturing, logistics, and energy are integrating advanced display systems to enhance operational efficiency and productivity. According to recent data, the automation market in the US is projected to grow at a CAGR of approximately 10% over the next five years. This trend indicates a strong correlation between automation and the need for sophisticated display systems that can provide real-time data visualization and monitoring. As companies strive to optimize their processes, the industrial display-system market is likely to benefit significantly from this shift towards automation, leading to enhanced decision-making and reduced operational costs.

Growing Importance of Data Visualization

The industrial display-system market is significantly impacted by the growing importance of data visualization in decision-making processes. As industries generate vast amounts of data, the need for effective display systems that can present this information in a clear and actionable manner becomes paramount. Companies are increasingly utilizing display systems to visualize key performance indicators (KPIs) and operational metrics, facilitating informed decision-making. The market for data visualization tools is projected to grow at a CAGR of around 12% in the coming years, indicating a strong demand for advanced display systems that can support this trend. Consequently, the industrial display-system market is likely to expand as organizations seek to harness the power of data visualization to drive performance improvements.

Increased Focus on Safety and Compliance

Safety regulations and compliance standards are becoming increasingly stringent across various industries, thereby influencing the industrial display-system market. Companies are required to implement systems that not only enhance operational efficiency but also ensure safety protocols are adhered to. For example, display systems that provide real-time alerts and monitoring capabilities are essential in sectors such as manufacturing and construction. The market is likely to see a rise in demand for display systems that integrate safety features, as organizations prioritize compliance with OSHA and other regulatory bodies. This focus on safety is expected to drive growth in the industrial display-system market, as businesses invest in technologies that mitigate risks and enhance workplace safety.

Expansion of Smart Manufacturing Initiatives

The industrial display-system market is poised for growth due to the expansion of smart manufacturing initiatives across the US. As manufacturers adopt Industry 4.0 principles, the integration of IoT devices and smart technologies becomes essential. Display systems that can interface with these technologies are critical for monitoring and controlling production processes. The smart manufacturing market is expected to reach $300 billion by 2025, highlighting the potential for growth in related sectors, including the industrial display-system market. This expansion indicates a shift towards more interconnected and intelligent manufacturing environments, where display systems play a vital role in facilitating real-time data access and operational insights.

Technological Advancements in Display Solutions

Technological innovations play a crucial role in shaping the industrial display-system market. The introduction of high-resolution displays, touch-screen interfaces, and ruggedized designs tailored for industrial environments enhances user experience and functionality. For instance, advancements in OLED and LED technologies have led to displays that offer superior brightness and energy efficiency. The market for industrial display systems is expected to reach approximately $3 billion by 2026, reflecting a robust growth trajectory fueled by these technological advancements. As industries increasingly seek to leverage cutting-edge display solutions, the industrial display-system market is poised for substantial growth, driven by the demand for enhanced visual communication and data presentation.