US Industrial Floor Coating Market Summary

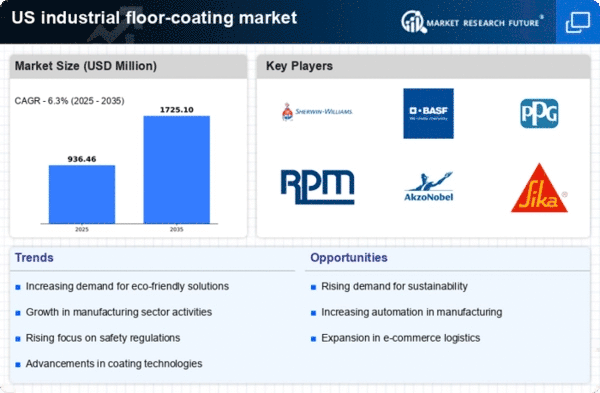

As per Market Research Future analysis, the US industrial floor-coating market Size was estimated at 880.96 USD Million in 2024. The US industrial floor-coating market is projected to grow from 936.46 USD Million in 2025 to 1725.1 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 6% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US industrial floor-coating market is experiencing a shift towards sustainability and technological innovation.

- Sustainability initiatives are increasingly influencing product development in the industrial floor-coating market.

- Technological advancements are driving the creation of more durable and efficient coating solutions.

- Customization and tailored solutions are becoming essential to meet diverse client needs across various sectors.

- Rising demand for durable flooring solutions and increased focus on workplace safety are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 880.96 (USD Million) |

| 2035 Market Size | 1725.1 (USD Million) |

| CAGR (2025 - 2035) | 6.3% |

Major Players

Sherwin-Williams (US), BASF (DE), PPG Industries (US), RPM International (US), AkzoNobel (NL), Sika AG (CH), Nippon Paint Holdings (JP), Tikkurila (FI)