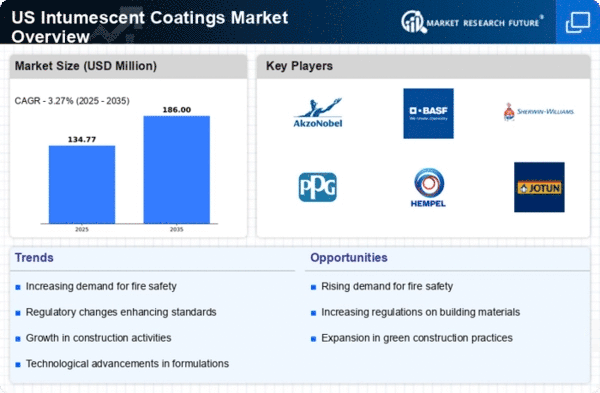

The intumescent coatings market is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as Sherwin-Williams (US), PPG Industries (US), and AkzoNobel (NL) are actively pursuing strategies that emphasize product development and market expansion. Sherwin-Williams (US) has focused on enhancing its product portfolio with eco-friendly formulations, which aligns with the growing demand for sustainable building materials. PPG Industries (US) has been investing in digital transformation initiatives to streamline operations and improve customer engagement, while AkzoNobel (NL) is leveraging its global presence to penetrate emerging markets, thereby enhancing its competitive positioning.The business tactics employed by these companies reflect a moderately fragmented market structure, where local manufacturing and supply chain optimization play crucial roles. Companies are increasingly localizing production to reduce lead times and costs, which is vital in a market that demands rapid response to customer needs. The collective influence of these key players is significant, as they not only drive innovation but also set industry standards that smaller competitors must follow.

In October Sherwin-Williams (US) announced the launch of a new line of intumescent coatings designed specifically for high-rise buildings, which underscores its commitment to safety and performance in construction. This strategic move is likely to enhance its market share in the commercial sector, where fire safety regulations are becoming more stringent. Furthermore, this initiative aligns with the broader trend of increasing regulatory compliance in the construction industry, positioning Sherwin-Williams (US) as a leader in safety-focused solutions.

In September PPG Industries (US) expanded its manufacturing capabilities by opening a new facility dedicated to the production of advanced intumescent coatings. This expansion not only signifies PPG's commitment to meeting rising demand but also reflects a strategic effort to enhance operational efficiency. By increasing production capacity, PPG Industries (US) is well-positioned to respond to market fluctuations and customer requirements, thereby solidifying its competitive edge.

In August AkzoNobel (NL) entered into a strategic partnership with a leading technology firm to develop AI-driven solutions for optimizing coating applications. This collaboration is indicative of a broader trend towards digitalization within the industry, as companies seek to leverage technology to improve product performance and customer service. The integration of AI into their operations may provide AkzoNobel (NL) with a significant advantage in terms of efficiency and innovation.

As of November the competitive trends in the intumescent coatings market are increasingly defined by digitalization, sustainability, and strategic alliances. Companies are shifting from traditional price-based competition to a focus on innovation and technology, which is likely to redefine competitive differentiation in the coming years. The emphasis on supply chain reliability and sustainable practices will further shape the landscape, suggesting that companies that can effectively integrate these elements into their strategies will emerge as leaders in the market.