Increased Focus on Security Features

Security concerns are becoming paramount in the ip phones market, as businesses prioritize the protection of sensitive information. The rise in cyber threats has led to a demand for ip phones equipped with advanced security features, such as encryption and secure access protocols. Organizations are increasingly aware that their communication systems must be safeguarded against potential breaches. The ip phones market is responding to this need by developing devices that offer robust security measures. It is projected that by 2025, the market for secure communication solutions will grow by approximately 15%, indicating a strong trend towards prioritizing security in communication technologies.

Rising Demand for Remote Work Solutions

The shift towards remote work has significantly impacted the ip phones market. As companies adapt to flexible work arrangements, the need for reliable communication tools has intensified. The ip phones market is witnessing an increase in demand for devices that facilitate seamless communication between remote employees and their teams. In 2025, it is estimated that around 60% of the workforce will engage in remote work, further driving the need for ip phones that offer features such as call forwarding, conferencing, and integration with collaboration tools. This trend suggests that the ip phones market will continue to expand as organizations invest in technology that supports their remote workforce.

Integration with Artificial Intelligence

The integration of artificial intelligence (AI) into communication systems is emerging as a key driver in the ip phones market. AI technologies are enhancing user experiences by providing features such as voice recognition, automated call routing, and predictive analytics. These innovations are likely to improve efficiency and streamline communication processes within organizations. As businesses increasingly recognize the benefits of AI in enhancing productivity, the ip phones market is expected to see a rise in demand for AI-enabled devices. By 2025, it is anticipated that the market for AI-driven communication solutions will grow by around 20%, reflecting the transformative impact of AI on the industry.

Technological Advancements in Communication

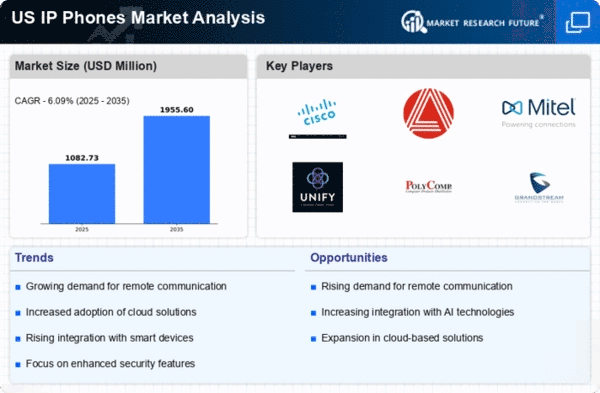

The ip phones market is experiencing a surge due to rapid technological advancements in communication systems. Innovations such as Voice over Internet Protocol (VoIP) and high-definition audio are enhancing the quality and efficiency of communication. As organizations increasingly adopt these technologies, the demand for advanced ip phones is likely to rise. In 2025, the market is projected to reach approximately $3 billion, reflecting a growth rate of around 10% annually. This growth is driven by the need for improved communication tools that support remote work and collaboration. The ip phones market is thus positioned to benefit from these advancements, as businesses seek to upgrade their communication infrastructure to remain competitive.

Growing Adoption of Unified Communication Solutions

The trend towards unified communication solutions is significantly influencing the ip phones market. Businesses are increasingly seeking integrated communication platforms that combine voice, video, and messaging services. This shift is driven by the desire for streamlined communication and improved collaboration among teams. The ip phones market is adapting to this demand by offering devices that seamlessly integrate with unified communication systems. In 2025, it is projected that the market for unified communication solutions will reach $5 billion, indicating a robust growth trajectory. This trend suggests that the ip phones market will continue to evolve as organizations prioritize comprehensive communication solutions.