Growing Demand in Healthcare Sector

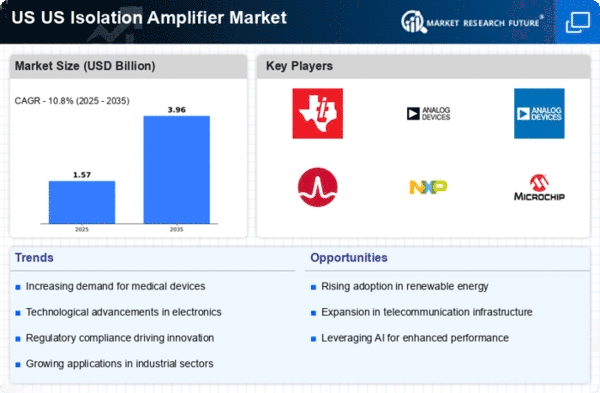

The US Isolation Amplifier Market is experiencing a notable surge in demand, particularly within the healthcare sector. As medical devices become increasingly sophisticated, the need for precise signal isolation and amplification is paramount. Isolation amplifiers are integral in ensuring patient safety by preventing electrical interference and protecting sensitive equipment. The healthcare industry is projected to account for a significant share of the market, driven by advancements in diagnostic and monitoring devices. According to recent estimates, the healthcare segment is expected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years. This growth is indicative of the rising reliance on electronic medical devices, which necessitate robust isolation solutions to maintain accuracy and reliability.

Expansion of Renewable Energy Sources

The US Isolation Amplifier Market is likely to benefit from the expansion of renewable energy sources, such as solar and wind power. As the energy sector transitions towards sustainable solutions, the integration of advanced monitoring and control systems becomes increasingly important. Isolation amplifiers are essential in these applications, as they help in isolating signals from various sensors and ensuring accurate data transmission. The renewable energy sector is projected to grow significantly, with investments in solar and wind energy expected to reach over $100 billion by 2026. This growth will likely create a substantial demand for isolation amplifiers, as they are critical for maintaining the reliability and efficiency of renewable energy systems.

Increased Focus on Safety and Compliance

The US Isolation Amplifier Market is significantly influenced by the increased focus on safety and compliance across various sectors. Regulatory bodies are imposing stringent safety standards to ensure the reliability of electronic devices, particularly in critical applications such as healthcare and industrial automation. Isolation amplifiers are essential in meeting these compliance requirements, as they provide necessary electrical isolation to protect users and equipment. The growing emphasis on safety is likely to drive the adoption of isolation amplifiers, as manufacturers seek to align their products with regulatory standards. Recent data suggests that the compliance-driven segment of the market is expected to grow at a CAGR of around 5% in the upcoming years, highlighting the importance of safety in the design and implementation of electronic systems.

Rising Adoption of Industrial Automation

The US Isolation Amplifier Market is poised for growth due to the increasing adoption of industrial automation across various sectors. As industries strive for enhanced efficiency and productivity, the integration of advanced automation technologies becomes essential. Isolation amplifiers play a critical role in industrial applications by ensuring signal integrity and protecting control systems from electrical noise. The manufacturing sector, in particular, is witnessing a shift towards smart factories, where the demand for reliable signal processing is paramount. Market data suggests that the industrial automation segment is expected to grow at a CAGR of around 7% in the coming years, further driving the need for isolation amplifiers to support complex automation systems.

Technological Innovations in Electronics

The US Isolation Amplifier Market is experiencing a transformation driven by technological innovations in electronics. The development of high-performance isolation amplifiers with enhanced features, such as low power consumption and high bandwidth, is reshaping the market landscape. These advancements are particularly relevant in applications requiring high precision and reliability, such as telecommunications and aerospace. The introduction of new materials and manufacturing techniques is also contributing to the evolution of isolation amplifiers, making them more efficient and cost-effective. Market analysts indicate that the electronics sector is expected to grow at a CAGR of approximately 6% over the next few years, further propelling the demand for advanced isolation solutions.