Increased Focus on Patient Safety

Patient safety has become a paramount concern in the US healthcare system, influencing the medical gases-and-equipment market. Hospitals and healthcare providers are implementing stringent protocols to ensure the safe administration of medical gases. This includes the adoption of advanced monitoring systems and equipment designed to prevent errors in gas delivery. The Joint Commission emphasizes the importance of safety standards, which has led to increased investments in medical gas systems. As a result, the medical gases-and-equipment market is likely to experience growth, with an estimated value of $8 billion by 2026, as facilities prioritize safety and compliance with regulatory standards.

Expansion of Healthcare Infrastructure

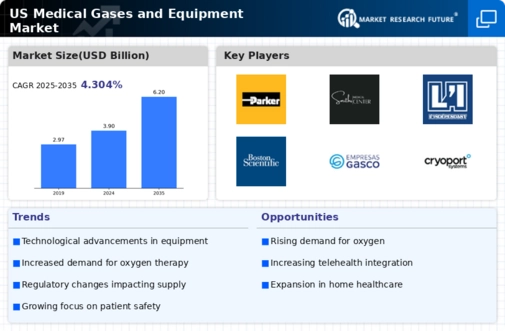

The ongoing expansion of healthcare facilities across the US is impacting significantly the medical gases-and-equipment market. New hospitals, outpatient centers, and specialized clinics are being established to meet the rising demand for healthcare services. This expansion necessitates the installation of medical gas systems, including oxygen, nitrous oxide, and medical air systems. The American Hospital Association reports that there are over 6,000 hospitals in the US, and many are upgrading their facilities to enhance patient care. As a result, the medical gases-and-equipment market is projected to grow at a CAGR of 7% through 2028, driven by the need for modernized healthcare infrastructure.

Rising Prevalence of Respiratory Diseases

The increasing incidence of respiratory diseases in the US is a primary driver for the medical gases-and-equipment market. Conditions such as asthma, chronic obstructive pulmonary disease (COPD), and pneumonia are becoming more prevalent, necessitating the use of medical gases like oxygen and nitrous oxide. According to the CDC, approximately 25 million Americans have asthma, and COPD affects around 16 million. This growing patient population requires effective management and treatment options, which in turn fuels demand for medical gases and related equipment. The medical gases-and-equipment market is expected to see a substantial increase in revenue, which may reach $10 billion by 2027, as healthcare providers seek to improve patient outcomes through advanced gas delivery systems.

Aging Population and Increased Healthcare Needs

The aging population in the US is a critical driver of the medical gases-and-equipment market. As individuals age, they often experience a higher incidence of chronic illnesses that require medical gas therapies. The US Census Bureau projects that by 2030, all baby boomers will be over 65, leading to a surge in healthcare demands. This demographic shift is likely to increase the need for medical gases such as oxygen and carbon dioxide for various treatments. Consequently, the medical gases-and-equipment market is expected to expand, with estimates suggesting a market value of $9 billion by 2028, as healthcare systems adapt to the needs of an older population.

Technological Innovations in Gas Delivery Systems

Technological advancements in gas delivery systems are reshaping the medical gases-and-equipment market. Innovations such as portable oxygen concentrators, automated gas delivery systems, and telehealth integration are enhancing the efficiency and effectiveness of gas administration. These technologies not only improve patient outcomes but also streamline operations within healthcare facilities. The market for portable oxygen concentrators alone is expected to grow by 15% annually, reflecting the demand for more versatile and user-friendly equipment. As healthcare providers increasingly adopt these innovations, the medical gases-and-equipment market is poised for significant growth, potentially reaching $12 billion by 2029.

Leave a Comment