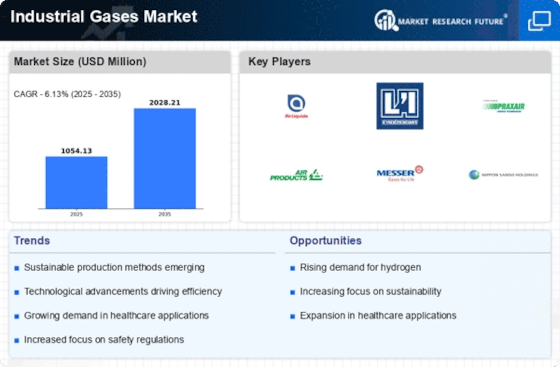

Rising Demand in Healthcare Sector

The healthcare sector's increasing reliance on industrial gases, particularly oxygen and nitrous oxide, is a notable driver for the Industrial Gases Market. The demand for medical gases has surged due to advancements in healthcare technologies and an expanding patient population. In 2025, the medical gases segment is projected to account for a substantial share of the market, driven by the growing number of surgical procedures and respiratory therapies. Furthermore, the rise in home healthcare services is likely to enhance the demand for portable gas delivery systems, thereby contributing to market growth. This trend indicates a shift towards more efficient healthcare solutions, which could further stimulate the Industrial Gases Market as providers seek to meet the evolving needs of patients.

Expansion of Food and Beverage Industry

The food and beverage industry plays a crucial role in driving the Industrial Gases Market, particularly through the use of gases such as carbon dioxide and nitrogen. These gases are essential for food preservation, packaging, and carbonation processes. As consumer preferences shift towards convenience foods and packaged products, the demand for industrial gases in this sector is expected to rise. In 2025, the food and beverage segment is anticipated to contribute significantly to the overall market growth, with an increasing focus on quality and safety standards. This expansion may lead to innovations in gas applications, further enhancing the efficiency of food processing and storage, thereby solidifying the Industrial Gases Market's position in the supply chain.

Technological Innovations in Gas Production

Technological advancements in gas production and distribution are transforming the Industrial Gases Market. Innovations such as membrane separation and cryogenic distillation are enhancing the efficiency of gas extraction and reducing operational costs. These technologies not only improve the purity of gases but also minimize environmental impact, aligning with sustainability goals. In 2025, the adoption of advanced technologies is expected to facilitate the growth of the industrial gases sector, as companies seek to optimize their production processes. This evolution may lead to the development of new applications and markets for industrial gases, thereby expanding the overall landscape of the Industrial Gases Market. The continuous pursuit of efficiency and sustainability could redefine competitive dynamics within the industry.

Increasing Focus on Environmental Regulations

The tightening of environmental regulations is a significant driver for the Industrial Gases Market. Governments worldwide are implementing stricter emissions standards and promoting cleaner technologies, which necessitate the use of industrial gases that comply with these regulations. For instance, the shift towards low-emission technologies in various industries is likely to increase the demand for gases such as hydrogen and carbon capture solutions. In 2025, the regulatory landscape is expected to evolve further, compelling industries to adopt cleaner practices. This shift may create opportunities for the Industrial Gases Market to innovate and develop new products that meet regulatory requirements while addressing environmental concerns. The interplay between regulation and market dynamics could lead to a more sustainable future for the industry.

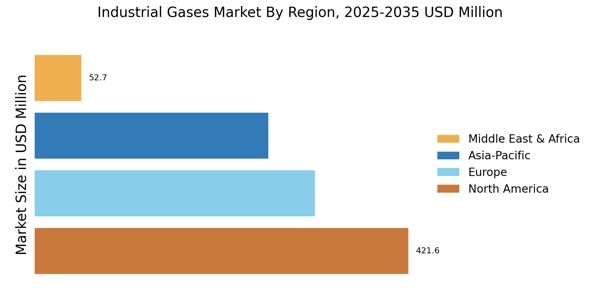

Growth in Manufacturing and Construction Sectors

The manufacturing and construction sectors are pivotal in propelling the Industrial Gases Market forward. The demand for gases such as argon, acetylene, and oxygen is closely linked to processes like welding, cutting, and metal fabrication. As industrial activities ramp up, particularly in emerging economies, the need for these gases is likely to increase. In 2025, the manufacturing sector is projected to witness robust growth, driven by infrastructure development and industrialization efforts. This trend suggests that the Industrial Gases Market will benefit from heightened activity in construction projects, which often require significant volumes of industrial gases for various applications. The interplay between these sectors and the gas market could lead to a more integrated approach to industrial operations.