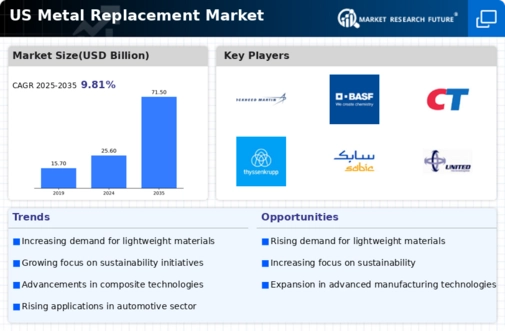

The metal replacement market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for lightweight materials and the push for sustainability across various industries. Key players such as Alcoa Inc (US), BASF SE (DE), and Hexcel Corporation (US) are strategically positioning themselves through innovation and partnerships. Alcoa Inc (US) focuses on developing advanced aluminum alloys that offer superior performance, while BASF SE (DE) emphasizes the integration of sustainable practices in its production processes. Hexcel Corporation (US) is leveraging its expertise in composite materials to cater to the aerospace and automotive sectors, thereby shaping a competitive environment that prioritizes technological advancement and environmental responsibility.

In terms of business tactics, companies are increasingly localizing manufacturing to enhance supply chain efficiency and reduce lead times. The market structure appears moderately fragmented, with several players vying for market share. However, the collective influence of major companies is significant, as they drive innovation and set industry standards. This competitive structure fosters an environment where collaboration and strategic partnerships are essential for growth and market penetration.

In November 2025, Alcoa Inc (US) announced a partnership with a leading automotive manufacturer to develop lightweight aluminum components aimed at reducing vehicle weight and improving fuel efficiency. This collaboration is strategically important as it aligns with the automotive industry's shift towards electrification and sustainability, potentially positioning Alcoa as a key supplier in the evolving market.

In October 2025, BASF SE (DE) launched a new line of bio-based polymers designed for use in various applications, including automotive and consumer goods. This initiative reflects BASF's commitment to sustainability and innovation, suggesting that the company is keen on capturing a growing segment of environmentally conscious consumers and industries.

In September 2025, Hexcel Corporation (US) expanded its production capabilities by investing in a new facility dedicated to advanced composite materials. This strategic move is likely to enhance Hexcel's competitive edge in the aerospace sector, where demand for lightweight and high-performance materials continues to rise, thereby solidifying its market position.

As of December 2025, current trends in the metal replacement market indicate a strong emphasis on digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the competitive landscape, as companies recognize the value of collaboration in driving innovation. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident, suggesting that future differentiation will hinge on the ability to innovate and adapt to changing market demands.

Leave a Comment