US Metallized Films Market Summary

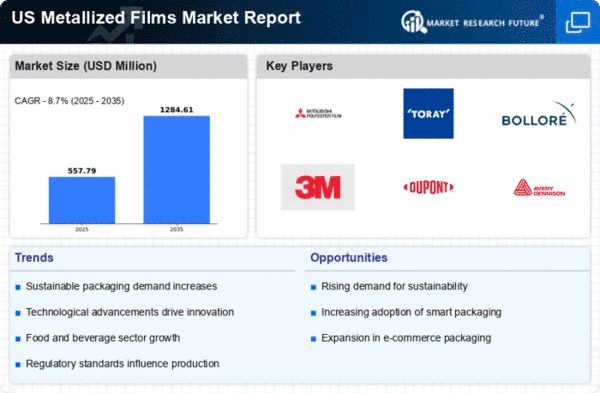

As per Market Research Future analysis, the US metallized films market Size was estimated at 513.15 USD Million in 2024. The US metallized films market is projected to grow from 557.79 USD Million in 2025 to 1284.61 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 8% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US metallized films market is poised for growth driven by sustainability and technological advancements.

- Sustainability initiatives are increasingly shaping the production and application of metallized films in various sectors.

- Technological advancements in film production are enhancing the performance and versatility of metallized films.

- The e-commerce sector is driving demand for flexible packaging solutions, particularly in the retail segment.

- Rising demand for flexible packaging and the expansion of the food and beverage sector are key drivers of market growth.

Market Size & Forecast

| 2024 Market Size | 513.15 (USD Million) |

| 2035 Market Size | 1284.61 (USD Million) |

| CAGR (2025 - 2035) | 8.7% |

Major Players

Mitsubishi Polyester Film (JP), Toray Industries (JP), Bolloré Group (FR), 3M Company (US), DuPont de Nemours (US), Avery Dennison Corporation (US), Jindal Poly Films (IN), Polyplex Corporation (IN), Klockner Pentaplast (DE)