Expansion of Point-of-Care Testing

The expansion of point-of-care testing (POCT) is significantly impacting the microfluidic devices market, as these technologies enable rapid and accurate diagnostics at the site of patient care. The convenience and speed of POCT are driving its adoption in various healthcare settings, including clinics and home care. The market for POCT is projected to grow at a CAGR of approximately 15% over the next few years, reflecting the increasing demand for accessible healthcare solutions. Microfluidic devices play a pivotal role in this trend, as they allow for miniaturized testing platforms that require minimal sample volumes and provide quick results. Consequently, the microfluidic devices market is well-positioned to benefit from the ongoing shift towards decentralized healthcare and the need for timely diagnostic information.

Rising Demand for Personalized Medicine

The microfluidic devices market is experiencing a notable surge in demand driven by the increasing focus on personalized medicine. As healthcare shifts towards tailored treatments, microfluidic technologies enable precise drug delivery and diagnostics. This market segment is projected to grow at a CAGR of approximately 20% over the next five years. The ability to conduct multiple tests simultaneously on a single platform enhances efficiency and reduces costs, making microfluidic devices essential in clinical settings. Furthermore, advancements in biomarker discovery and genetic testing are likely to propel the adoption of these devices, as they facilitate rapid and accurate patient-specific solutions. Consequently, the microfluidic devices market is poised for substantial growth as healthcare providers seek innovative ways to improve patient outcomes through personalized approaches.

Technological Advancements in Microfluidics

Technological innovations are significantly influencing the microfluidic devices market, enhancing their capabilities and applications. Recent developments in materials science, such as the use of polymers and nanomaterials, have improved the performance and reliability of microfluidic devices. These advancements allow for more complex fluid manipulations and integration with electronic systems, which is crucial for applications in diagnostics and drug delivery. The market is expected to reach a valuation of over $10 billion by 2026, driven by these technological enhancements. Moreover, the integration of artificial intelligence and machine learning into microfluidic systems is likely to optimize processes and improve data analysis, further expanding the market's potential. As a result, the microfluidic devices market is becoming increasingly sophisticated, catering to diverse applications across various sectors.

Growing Investment in Research and Development

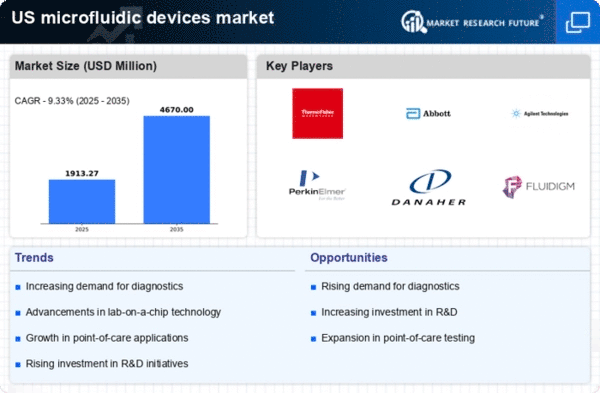

Investment in research and development (R&D) is a critical driver for the microfluidic devices market, as it fosters innovation and the introduction of new products. Increased funding from both public and private sectors is facilitating the exploration of novel applications, particularly in the fields of diagnostics and therapeutics. In the US, federal grants and venture capital investments are supporting startups and established companies alike, leading to breakthroughs in microfluidic technology. This influx of capital is expected to enhance the market's growth trajectory, with projections indicating a compound annual growth rate of around 18% through 2027. As R&D efforts continue to expand, the microfluidic devices market is likely to witness the emergence of cutting-edge solutions that address unmet medical needs and improve healthcare delivery.

Regulatory Support and Standardization Efforts

Regulatory support and standardization efforts are emerging as vital drivers for the microfluidic devices market, as they enhance product reliability and consumer confidence. Regulatory bodies in the US are increasingly recognizing the potential of microfluidic technologies, leading to streamlined approval processes for innovative devices. This supportive environment encourages manufacturers to invest in the development of new products, knowing that they can navigate regulatory hurdles more efficiently. Additionally, standardization initiatives are being established to ensure quality and interoperability among devices, which is crucial for widespread adoption. As a result, the microfluidic devices market is likely to experience accelerated growth, with a projected increase in market size driven by the assurance of safety and efficacy in new technologies.