Rising Demand for Energy Resilience

The microgrid monitoring market is experiencing a surge in demand driven by the increasing need for energy resilience across various sectors. As natural disasters and extreme weather events become more frequent, organizations are seeking solutions that ensure uninterrupted power supply. This trend is particularly evident in critical infrastructure such as hospitals and data centers, where energy reliability is paramount. The market is projected to grow at a CAGR of approximately 15% over the next five years, indicating a robust shift towards microgrid solutions. Enhanced monitoring capabilities allow for real-time data analysis, enabling operators to respond swiftly to disruptions. Consequently, the microgrid monitoring market is positioned to play a crucial role in enhancing energy security and reliability in the face of growing environmental challenges.

Technological Innovations in Monitoring Systems

Technological advancements are significantly influencing the microgrid monitoring market, as innovations in monitoring systems enhance operational efficiency and reliability. The integration of IoT devices and advanced sensors allows for real-time data collection and analysis, facilitating proactive management of energy resources. These innovations not only improve system performance but also reduce operational costs. For instance, predictive maintenance enabled by advanced analytics can decrease downtime by up to 30%, thereby optimizing energy distribution. The market is expected to witness an increase in investment, with projections indicating a potential growth of $1 billion by 2027. As technology continues to evolve, the microgrid monitoring market is likely to benefit from enhanced capabilities that support smarter energy management.

Increased Investment in Smart Grid Infrastructure

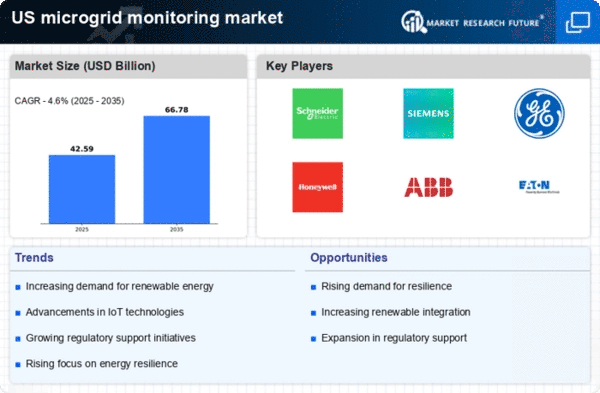

The microgrid monitoring market is benefiting from a significant increase in investment directed towards smart grid infrastructure. As utilities and governments recognize the importance of modernizing energy systems, funding for microgrid projects is on the rise. In 2025, investments in smart grid technologies are anticipated to reach approximately $30 billion in the US alone. This influx of capital is expected to enhance the deployment of microgrid monitoring solutions, which are essential for managing distributed energy resources effectively. Furthermore, the integration of smart grid technologies with microgrid systems allows for improved data analytics and operational efficiency. As a result, the microgrid monitoring market is likely to expand, driven by the need for more resilient and efficient energy systems.

Growing Focus on Sustainability and Carbon Reduction

The microgrid monitoring market is increasingly influenced by the growing focus on sustainability and carbon reduction initiatives. Organizations across various sectors are prioritizing the transition to cleaner energy sources, which necessitates effective monitoring solutions to manage these resources efficiently. The US government has set ambitious targets to reduce greenhouse gas emissions by 50% by 2030, which is likely to drive the adoption of microgrid technologies. This shift towards sustainability not only aligns with regulatory requirements but also enhances corporate social responsibility efforts. As companies invest in renewable energy and energy efficiency, the demand for microgrid monitoring solutions is expected to rise, positioning the market for substantial growth in the coming years.

Enhanced Regulatory Frameworks Supporting Microgrid Development

The microgrid monitoring market is positively impacted by enhanced regulatory frameworks that support the development and deployment of microgrid technologies. Recent policies aimed at promoting energy independence and resilience have created a favorable environment for microgrid projects. For instance, state-level incentives and federal grants are encouraging investments in microgrid infrastructure. In 2025, it is estimated that regulatory support could lead to a 20% increase in microgrid installations across the US. This supportive regulatory landscape not only facilitates the growth of the microgrid monitoring market but also encourages innovation and collaboration among stakeholders. As regulations continue to evolve, the market is likely to see increased activity and investment, further driving its expansion.

.png)