Increased Defense Budgets

The military embedded-systems market is significantly influenced by the increase in defense budgets across various branches of the U.S. military. In 2025, the defense budget is projected to reach $850 billion, reflecting a 5% increase from the previous year. This financial commitment is aimed at modernizing military capabilities, including the procurement of advanced embedded systems. As the military seeks to enhance operational efficiency and maintain technological superiority, the demand for sophisticated embedded systems is expected to rise. This trend suggests that manufacturers in the military embedded-systems market may benefit from increased contracts and funding opportunities, thereby fostering innovation and development in this sector.

Advancements in Sensor Technology

The military embedded-systems market is experiencing a notable surge due to advancements in sensor technology. Enhanced sensors are critical for applications such as surveillance, reconnaissance, and target acquisition. These innovations enable military systems to gather and process data with unprecedented accuracy and speed. For instance, the integration of high-resolution imaging sensors and multi-spectral sensors has improved situational awareness on the battlefield. The U.S. Department of Defense has allocated approximately $15 billion for sensor technology development in the fiscal year 2025, indicating a strong commitment to enhancing military capabilities. This investment is likely to drive demand for embedded systems that can effectively process and analyze sensor data, thereby propelling growth in the military embedded-systems market.

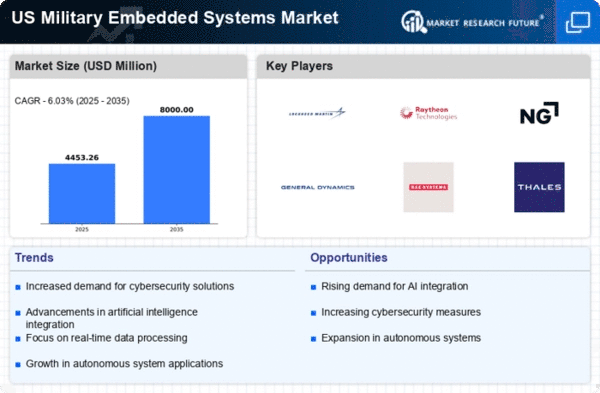

Emphasis on Real-Time Data Processing

The military embedded-systems market is increasingly characterized by an emphasis on real-time data processing capabilities. As military operations become more complex, the need for systems that can process vast amounts of data instantaneously is paramount. This demand is driven by the necessity for timely decision-making in critical situations. The U.S. military has recognized this need and is investing in technologies that enhance real-time data processing, with an estimated budget allocation of $5 billion for related projects in 2025. This focus on real-time capabilities is likely to stimulate growth in the military embedded-systems market, as manufacturers develop solutions that meet these stringent requirements.

Growing Demand for Autonomous Systems

The military embedded-systems market is witnessing a growing demand for autonomous systems, which are increasingly being integrated into military operations. These systems, including unmanned aerial vehicles (UAVs) and autonomous ground vehicles, rely heavily on embedded technologies for navigation, control, and data processing. The U.S. military has identified autonomy as a key focus area, with plans to invest over $10 billion in autonomous systems by 2026. This investment is likely to drive advancements in embedded systems that support autonomous functionalities, thereby enhancing operational capabilities. The integration of artificial intelligence and machine learning into these systems further amplifies the potential for growth in the military embedded-systems market.

Regulatory and Compliance Requirements

The military embedded-systems market is also shaped by stringent regulatory and compliance requirements imposed by the U.S. government. These regulations ensure that military systems meet specific standards for performance, security, and interoperability. Compliance with these standards is essential for contractors and manufacturers seeking to participate in government contracts. The U.S. Department of Defense has established guidelines that dictate the necessary certifications for embedded systems, which can influence design and development processes. As a result, companies in the military embedded-systems market must invest in research and development to ensure compliance, potentially driving innovation and enhancing the overall quality of embedded systems.