Expansion of Electric Vehicle Market

The expansion of the electric vehicle market is significantly impacting the Embedded Boards for Infotainment Systems in Automotive Market. As more consumers opt for electric vehicles, the demand for sophisticated infotainment systems that enhance the driving experience is rising. Electric vehicles often come equipped with advanced technology, necessitating the integration of high-performance embedded boards that can handle complex functionalities such as energy management, navigation, and entertainment. Market forecasts indicate that the electric vehicle segment is expected to grow at a rate of approximately 20% annually, which will likely drive the demand for innovative embedded solutions tailored for these vehicles, thereby reshaping the infotainment landscape.

Regulatory Push for Enhanced Safety Features

Regulatory frameworks are increasingly influencing the Embedded Boards for Infotainment Systems in Automotive Market, particularly concerning safety features. Governments worldwide are implementing stringent regulations aimed at improving vehicle safety, which includes the integration of advanced driver-assistance systems (ADAS) and infotainment functionalities that promote safe driving practices. Embedded boards are essential for supporting these systems, as they enable real-time data processing and communication between various vehicle components. The market is likely to see a rise in demand for embedded solutions that comply with these regulations, potentially leading to a growth rate of around 8% in the safety-oriented infotainment segment over the next few years.

Technological Advancements in Embedded Systems

Technological advancements play a pivotal role in shaping the Embedded Boards for Infotainment Systems in Automotive Market. The rapid evolution of microprocessors, memory technologies, and software platforms has enabled the development of more powerful and efficient embedded boards. These advancements facilitate the integration of complex functionalities such as real-time data processing, multimedia playback, and connectivity options like 5G and Wi-Fi 6. As automotive manufacturers strive to differentiate their offerings, the adoption of cutting-edge embedded technologies becomes essential. Market analysis suggests that the increasing complexity of infotainment systems will drive a significant portion of the embedded boards market, with an expected growth rate of around 12% in the coming years.

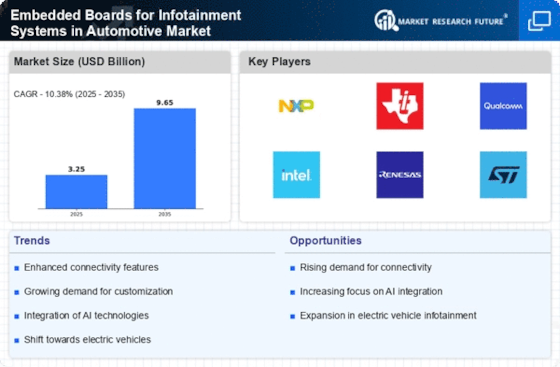

Rising Demand for Advanced Infotainment Features

The Embedded Boards for Infotainment Systems in Automotive Market is experiencing a notable surge in demand for advanced infotainment features. Consumers increasingly seek seamless connectivity, enhanced navigation, and personalized experiences within their vehicles. This trend is driven by the proliferation of smartphones and the expectation for in-car systems to mirror mobile functionalities. As a result, automotive manufacturers are investing heavily in sophisticated embedded boards that support high-definition displays, voice recognition, and integration with various applications. Market data indicates that the infotainment segment is projected to grow at a compound annual growth rate of approximately 10% over the next five years, reflecting the industry's commitment to enhancing user experience through innovative embedded solutions.

Growing Focus on User Experience and Customization

The Embedded Boards for Infotainment Systems in Automotive Market is increasingly influenced by a growing focus on user experience and customization. Consumers are no longer satisfied with standard infotainment systems; they demand personalized interfaces and features tailored to their preferences. This shift has prompted manufacturers to invest in embedded boards that support customizable user interfaces, adaptive learning algorithms, and enhanced interaction capabilities. As a result, the market is witnessing a rise in partnerships between automotive companies and technology firms to co-develop innovative solutions. Data indicates that the customization aspect is expected to contribute significantly to market growth, with projections suggesting a 15% increase in demand for tailored infotainment systems over the next few years.