Automotive Infotainment Market Summary

As per Market Research Future analysis, the Automotive Infotainment Market Size was estimated at 32.03 USD Billion in 2024. The Automotive Infotainment industry is projected to grow from 34.75 USD Billion in 2025 to 78.65 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 8.51% during the forecast period 2025 - 2035

Key Market Trends & Highlights

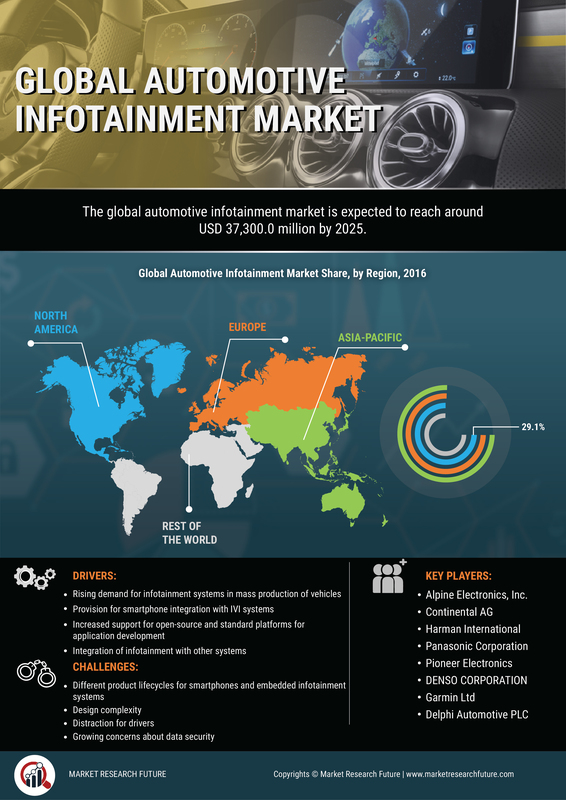

The Automotive Infotainment Market is poised for substantial growth driven by technological advancements and evolving consumer preferences.

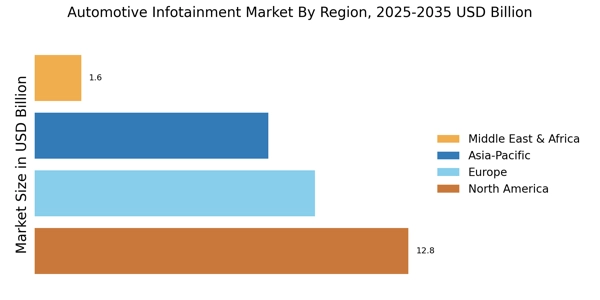

- North America remains the largest market for automotive infotainment, characterized by a strong demand for advanced connectivity features.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by increasing vehicle production and consumer adoption of smart technologies.

- QNX continues to dominate the market as the leading platform, while Linux is rapidly gaining traction due to its flexibility and open-source nature.

- Key market drivers include the rise of electric and autonomous vehicles, alongside heightened consumer demand for personalization in infotainment systems.

Market Size & Forecast

| 2024 Market Size | 32.03 (USD Billion) |

| 2035 Market Size | 78.65 (USD Billion) |

| CAGR (2025 - 2035) | 8.51% |

Major Players

Robert Bosch GmbH (DE), Denso Corporation (JP), Continental AG (DE), Harman International (US), Pioneer Corporation (JP), Panasonic Corporation (JP), NXP Semiconductors (NL), Visteon Corporation (US), LG Electronics (KR), Alpine Electronics (JP)