Focus on Connectivity Solutions

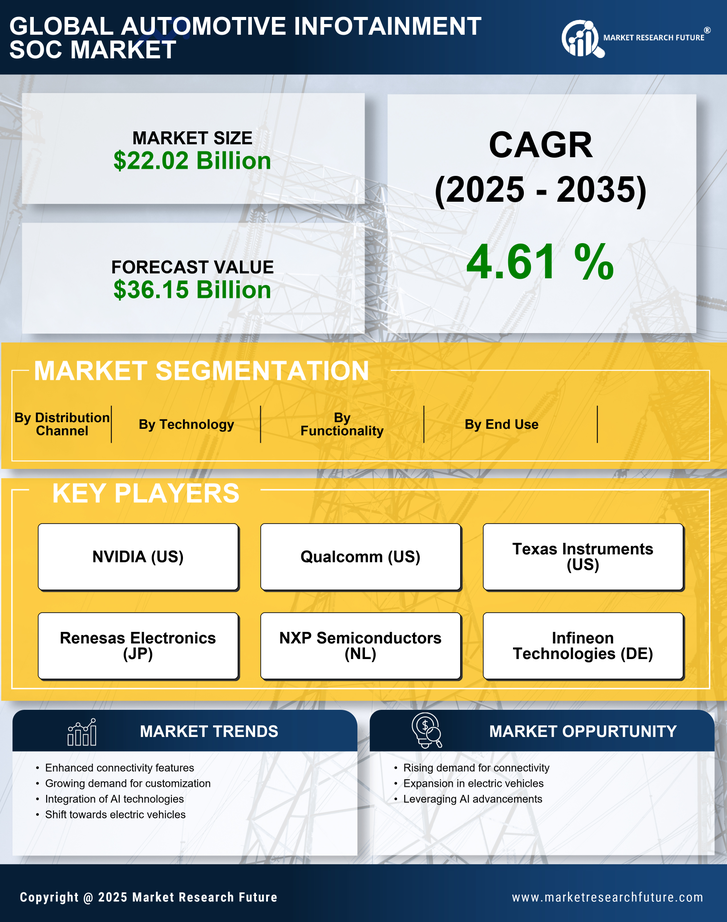

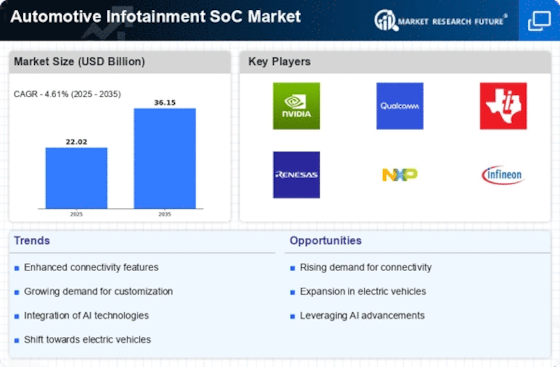

Connectivity remains a pivotal driver in the Automotive Infotainment SoC Market, as consumers increasingly demand seamless integration with their mobile devices. The rise of 5G technology is particularly influential, offering faster data transfer rates and lower latency, which are crucial for real-time applications. This trend is reflected in the growing number of vehicles equipped with advanced connectivity features, such as in-car Wi-Fi and smartphone integration platforms. Market analysts estimate that the demand for connected vehicles will lead to a compound annual growth rate of over 15% in the infotainment sector by 2025. As automakers prioritize connectivity, SoC manufacturers are compelled to innovate, ensuring their products can support the latest communication protocols and standards, thus enhancing the overall driving experience.

Integration of Advanced Technologies

The Automotive Infotainment SoC Market is experiencing a notable shift towards the integration of advanced technologies such as artificial intelligence and machine learning. These technologies enhance user experience by enabling personalized content delivery and predictive analytics. As a result, manufacturers are increasingly investing in SoCs that support these capabilities. The market for automotive SoCs is projected to reach approximately 30 billion USD by 2026, driven by the demand for smarter infotainment systems. This integration not only improves functionality but also allows for seamless updates and upgrades, which are essential in a rapidly evolving technological landscape. Furthermore, the incorporation of augmented reality features is becoming more prevalent, providing drivers with enhanced navigation and information display, thereby increasing the appeal of modern vehicles.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are becoming increasingly critical in the Automotive Infotainment SoC Market. Governments worldwide are implementing stringent regulations regarding vehicle safety and data privacy, which directly impact the design and functionality of infotainment systems. Manufacturers must ensure that their SoCs comply with these regulations, which often necessitates additional features such as data encryption and secure connectivity. The market is witnessing a trend where compliance not only serves as a legal requirement but also as a competitive advantage. Analysts predict that adherence to safety standards will drive innovation in infotainment technologies, as companies strive to create systems that are not only compliant but also enhance the overall safety of the vehicle. This focus on regulatory compliance is likely to shape the future development of automotive SoCs.

Consumer Demand for Enhanced User Experience

Consumer expectations for enhanced user experiences are a driving force in the Automotive Infotainment SoC Market. As technology evolves, users seek infotainment systems that offer intuitive interfaces, voice recognition, and personalized content. This demand is pushing manufacturers to develop SoCs that can support high-resolution displays and advanced graphics capabilities. Market Research Future indicates that the preference for user-friendly interfaces is leading to a surge in the adoption of touchscreens and gesture controls in vehicles. Furthermore, the integration of voice assistants is becoming increasingly common, allowing drivers to interact with their infotainment systems without distraction. This focus on user experience is likely to result in a competitive landscape where manufacturers must continuously innovate to meet consumer expectations.

Shift Towards Electric and Autonomous Vehicles

The Automotive Infotainment SoC Market is significantly influenced by the ongoing shift towards electric and autonomous vehicles. As automakers transition to electric powertrains, the need for sophisticated infotainment systems that can manage energy consumption and provide real-time data becomes paramount. Additionally, autonomous vehicles require advanced SoCs capable of processing vast amounts of data from various sensors and cameras. This trend is expected to drive the market for automotive SoCs, with projections indicating a potential market size of 25 billion USD by 2025. The integration of infotainment systems in electric and autonomous vehicles not only enhances user engagement but also plays a critical role in safety and navigation, making it a vital area of focus for manufacturers.