Focus on Interoperability

Interoperability is becoming increasingly critical in the military radio-system market. As joint operations among different branches of the armed forces and allied nations become more common, the need for compatible communication systems is paramount. The military is investing in technologies that facilitate seamless communication across various platforms, ensuring that forces can collaborate effectively during missions. This focus on interoperability is likely to drive demand for radio systems that can integrate with existing infrastructure while supporting diverse communication protocols. As a result, manufacturers are expected to prioritize the development of solutions that enhance connectivity and operational cohesion, thereby expanding the military radio-system market.

Increased Defense Budgets

The military radio-system market in the US is experiencing growth due to increased defense budgets. The US government has allocated substantial funds to enhance military capabilities, with a focus on communication systems. In fiscal year 2025, the defense budget reached approximately $850 billion, reflecting a 5% increase from the previous year. This financial commitment is likely to drive demand for advanced military radio systems, as the armed forces seek to modernize their communication infrastructure. Enhanced funding allows for the procurement of state-of-the-art technologies, ensuring that military personnel can operate effectively in diverse environments. As a result, the military radio-system market is poised for expansion, with manufacturers responding to the heightened demand for reliable and secure communication solutions.

Regulatory Compliance and Standardization

Regulatory compliance and standardization are essential drivers in the military radio-system market. The US government has established stringent guidelines to ensure that communication systems meet specific performance and security standards. Compliance with these regulations is crucial for manufacturers seeking to supply the military. As the demand for secure and reliable communication systems grows, adherence to regulatory frameworks will likely influence purchasing decisions. The military radio-system market is expected to expand as manufacturers invest in developing compliant technologies that align with government standards. This focus on regulatory compliance not only enhances the credibility of products but also fosters trust among military stakeholders.

Emerging Threats and Geopolitical Tensions

The military radio-system market is influenced by emerging threats and geopolitical tensions. The evolving security landscape necessitates robust communication systems to address potential conflicts. In recent years, the US has faced challenges from various state and non-state actors, prompting a reevaluation of military strategies. This environment creates a pressing need for advanced radio systems that can ensure secure and uninterrupted communication during operations. The military radio-system market is likely to benefit from investments aimed at countering these threats. The armed forces prioritize technologies that enhance situational awareness and operational effectiveness. Consequently, manufacturers are expected to innovate and develop solutions that meet the demands of modern warfare.

Technological Advancements in Communication

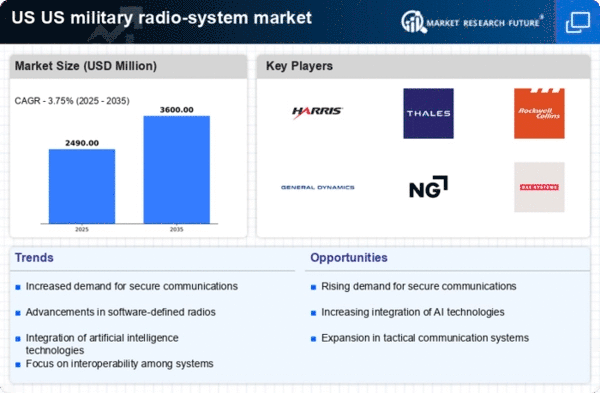

Technological advancements are a key driver of the military radio-system market. Innovations in communication technologies, such as software-defined radios and enhanced encryption methods, are transforming the landscape. The integration of artificial intelligence and machine learning into radio systems is expected to improve operational efficiency and decision-making capabilities. As the military seeks to leverage these advancements, the market is likely to witness a surge in demand for next-generation communication solutions. In 2025, the military radio-system market is projected to grow at a CAGR of 6%, driven by the need for systems that can adapt to rapidly changing operational requirements. This trend indicates a shift towards more versatile and capable communication platforms.