Rising Healthcare Expenditure

Healthcare expenditure in the United States continues to rise, which significantly impacts the osteoarthritis market. In 2023, healthcare spending reached approximately $4.3 trillion, with a substantial portion allocated to managing chronic conditions like osteoarthritis. This trend suggests that patients and healthcare providers are increasingly willing to invest in effective treatments, including medications, physical therapy, and surgical interventions. The financial commitment to managing osteoarthritis reflects the condition's impact on daily living and productivity. As healthcare costs continue to escalate, the osteoarthritis market is likely to see increased investment in research and development, leading to the introduction of new therapies and treatment modalities that address the needs of patients.

Increased Awareness and Education

There is a growing awareness and education surrounding osteoarthritis, which serves as a significant driver for the osteoarthritis market. Public health campaigns and educational initiatives have been instrumental in informing patients about the symptoms, risk factors, and available treatment options for osteoarthritis. This heightened awareness encourages individuals to seek medical advice and treatment earlier, potentially leading to better management of the condition. Furthermore, healthcare professionals are increasingly educated about the latest advancements in osteoarthritis management, which may influence treatment decisions. As awareness continues to expand, the demand for effective therapies and interventions in the osteoarthritis market is likely to increase, fostering innovation and development.

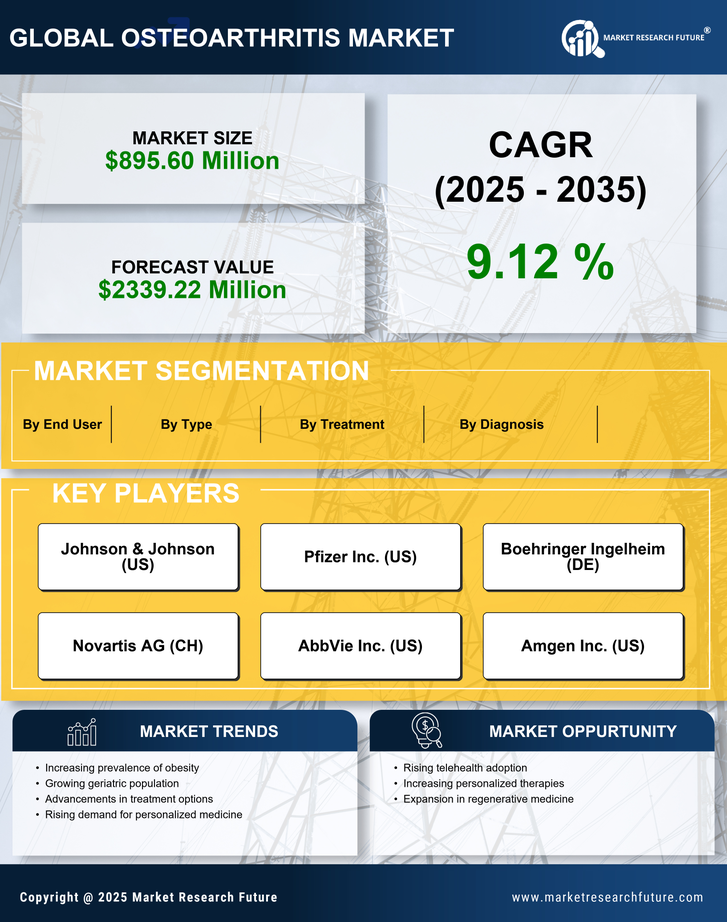

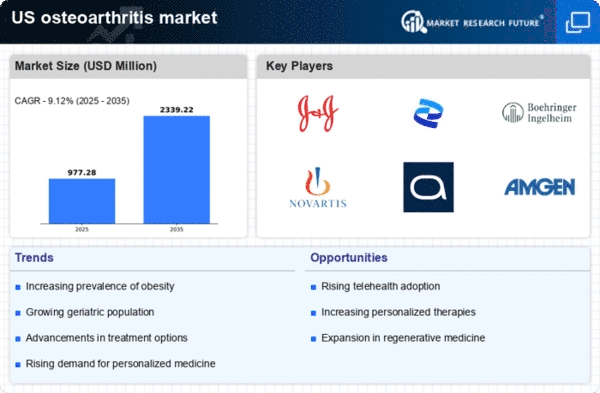

Growing Demand for Personalized Medicine

The trend towards personalized medicine is becoming increasingly relevant in the osteoarthritis market. Patients are seeking tailored treatment plans that consider their unique genetic, environmental, and lifestyle factors. This shift towards individualized care is driven by advancements in genetic research and technology, which enable healthcare providers to develop more effective treatment strategies. Personalized approaches may enhance treatment efficacy and patient satisfaction, as they align more closely with individual needs. As the demand for personalized medicine grows, the osteoarthritis market is likely to adapt, fostering innovation in treatment options and improving patient outcomes. This evolution may also encourage collaboration between researchers, clinicians, and pharmaceutical companies to develop targeted therapies.

Aging Population and Osteoarthritis Prevalence

The aging population in the United States is a primary driver of the osteoarthritis market. As individuals age, the likelihood of developing osteoarthritis increases significantly. Current estimates suggest that approximately 27 million adults in the US suffer from this condition, with the prevalence expected to rise as the population ages. By 2030, it is projected that nearly 67 million adults will be affected, indicating a growing demand for treatment options. This demographic shift necessitates advancements in the osteoarthritis market, as healthcare providers seek effective solutions to manage symptoms and improve quality of life for older adults. The increasing burden of osteoarthritis on healthcare systems further emphasizes the need for innovative therapies and interventions.

Advancements in Biologics and Regenerative Medicine

The osteoarthritis market is experiencing a surge in advancements related to biologics and regenerative medicine. These innovative treatment options, including stem cell therapy and platelet-rich plasma (PRP) injections, offer promising alternatives to traditional therapies. Research indicates that biologics may provide significant pain relief and improved joint function for osteoarthritis patients. As these therapies gain traction, they are likely to reshape treatment paradigms within the osteoarthritis market. The potential for biologics to address the underlying causes of osteoarthritis, rather than merely alleviating symptoms, could lead to a paradigm shift in how the condition is managed. This evolution in treatment options may attract investment and research funding, further propelling the market forward.