Rising Obesity Rates

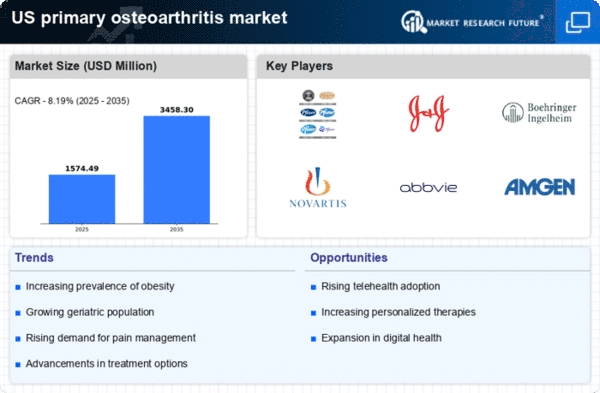

The prevalence of obesity in the US is a critical driver impacting the primary osteoarthritis market. Data suggests that approximately 42.4% of adults in the US are classified as obese, a condition that significantly increases the risk of developing osteoarthritis due to the added stress on weight-bearing joints. This correlation indicates a growing patient population that may require treatment for osteoarthritis, thereby expanding the market. As healthcare professionals increasingly recognize the link between obesity and joint health, there is a push for integrated treatment approaches that address both weight management and osteoarthritis. This trend may lead to a rise in demand for therapeutic interventions, further propelling the primary osteoarthritis market.

Growing Healthcare Expenditure

The primary osteoarthritis market is experiencing a notable increase in healthcare expenditure in the US. As the population ages, healthcare spending is projected to rise significantly, with estimates indicating that it could reach over $4 trillion by 2025. This surge in spending is likely to enhance access to various treatment options for osteoarthritis, including medications, physical therapy, and surgical interventions. Furthermore, the increased allocation of funds towards research and development may lead to innovative therapies, thereby expanding the primary osteoarthritis market. The focus on improving patient outcomes and quality of life is driving healthcare providers to invest more in osteoarthritis management, which could potentially lead to a more robust market landscape.

Expansion of Telehealth Services

The rise of telehealth services is significantly influencing the primary osteoarthritis market. With the increasing adoption of digital health technologies, patients now have greater access to healthcare professionals from the comfort of their homes. This trend is particularly beneficial for individuals with mobility issues or those living in remote areas. Telehealth consultations can facilitate timely assessments and management of osteoarthritis, ensuring that patients receive appropriate care without the barriers of traditional healthcare settings. As telehealth continues to expand, it is likely to enhance patient engagement and adherence to treatment plans, thereby positively impacting the primary osteoarthritis market.

Increased Focus on Preventive Care

The primary osteoarthritis market is witnessing a shift towards preventive care strategies. Healthcare providers are increasingly emphasizing the importance of early intervention and lifestyle modifications to mitigate the risk of developing osteoarthritis. This proactive approach includes promoting physical activity, weight management, and nutritional counseling. As awareness of the benefits of preventive care grows, more individuals are likely to seek guidance on maintaining joint health, which could lead to an increase in demand for preventive services and products. This trend may not only enhance patient outcomes but also contribute to the overall growth of the primary osteoarthritis market as healthcare systems adapt to prioritize prevention.

Technological Innovations in Diagnostics

Technological advancements in diagnostic tools are transforming the primary osteoarthritis market. Innovations such as advanced imaging techniques, including MRI and ultrasound, allow for earlier and more accurate diagnosis of osteoarthritis. These developments enable healthcare providers to tailor treatment plans more effectively, potentially improving patient outcomes. The integration of artificial intelligence in diagnostic processes is also emerging, which may enhance the efficiency and accuracy of identifying osteoarthritis. As these technologies become more accessible, they are likely to increase the number of diagnosed cases, thereby expanding the primary osteoarthritis market. The emphasis on precision medicine is expected to drive further investment in diagnostic innovations.