US Polyimide Film Market Summary

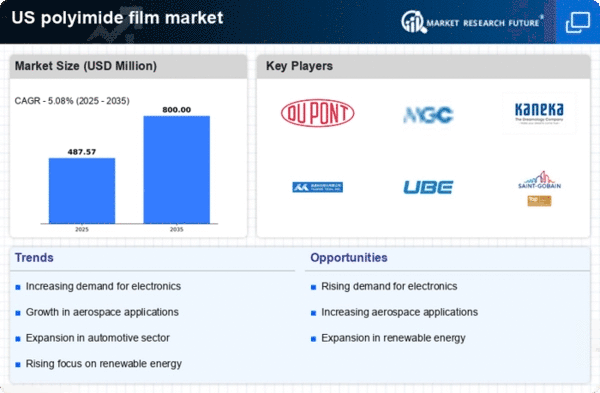

As per Market Research Future analysis, the US polyimide film market Size was estimated at 464.0 USD Million in 2024. The US polyimide film market is projected to grow from 487.57 USD Million in 2025 to 800.0 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 5.0% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US polyimide film market is poised for growth driven by technological advancements and increasing applications across various sectors.

- Rising demand in electronics is a key trend, with polyimide films being essential for flexible circuits and displays.

- The aerospace sector is experiencing growth, as polyimide films are utilized for their lightweight and thermal stability properties.

- Sustainability initiatives are influencing the market, as manufacturers seek eco-friendly materials and processes.

- Technological advancements in manufacturing and increased focus on aerospace innovations are major drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 464.0 (USD Million) |

| 2035 Market Size | 800.0 (USD Million) |

| CAGR (2025 - 2035) | 5.08% |

Major Players

DuPont (US), Mitsubishi Gas Chemical (JP), Kaneka Corporation (JP), Taimide Technology (TW), Ube Industries (JP), Saint-Gobain (FR), Wuxi Shenxi Technology (CN), Yancheng Hengsheng Insulation Material (CN)