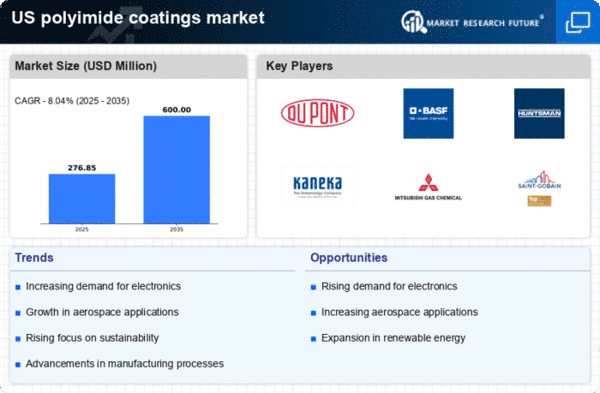

The polyimide coatings market exhibits a dynamic competitive landscape characterized by innovation and strategic partnerships. Key players such as

DuPont (US), BASF (DE), and Huntsman (US) are actively shaping the market through their distinct operational focuses. DuPont (US) emphasizes innovation in high-performance materials, particularly in aerospace and electronics, while BASF (DE) leverages its extensive research capabilities to enhance product performance and sustainability. Huntsman (US) is strategically positioned with a focus on expanding its product portfolio to cater to the growing demand in automotive and electronics sectors. Collectively, these strategies foster a competitive environment that prioritizes technological advancement and market responsiveness.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. The market structure appears moderately fragmented, with several players vying for market share. This fragmentation allows for diverse offerings but also intensifies competition among key players, compelling them to innovate continuously and enhance operational efficiencies.

In October DuPont (US) announced a partnership with a leading aerospace manufacturer to develop advanced polyimide coatings tailored for high-temperature applications. This collaboration is significant as it not only reinforces DuPont's commitment to innovation but also positions the company to capture a larger share of the aerospace market, which is increasingly demanding specialized coatings that can withstand extreme conditions.

In September BASF (DE) launched a new line of eco-friendly polyimide coatings aimed at reducing environmental impact. This strategic move aligns with global sustainability trends and positions BASF as a leader in providing environmentally responsible solutions. The introduction of these products is likely to attract customers who prioritize sustainability, thereby enhancing BASF's competitive edge.

In August Huntsman (US) expanded its manufacturing capabilities in North America by investing in a new facility dedicated to polyimide coatings production. This expansion is crucial as it not only increases production capacity but also enhances Huntsman's ability to meet the rising demand in the electronics sector, where high-performance coatings are essential. The investment reflects a proactive approach to market growth and customer satisfaction.

As of November current competitive trends indicate a strong emphasis on digitalization, sustainability, and the integration of AI technologies within the polyimide coatings market. Strategic alliances are increasingly shaping the landscape, enabling companies to pool resources and expertise. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This shift underscores the importance of agility and responsiveness in meeting the evolving needs of customers.