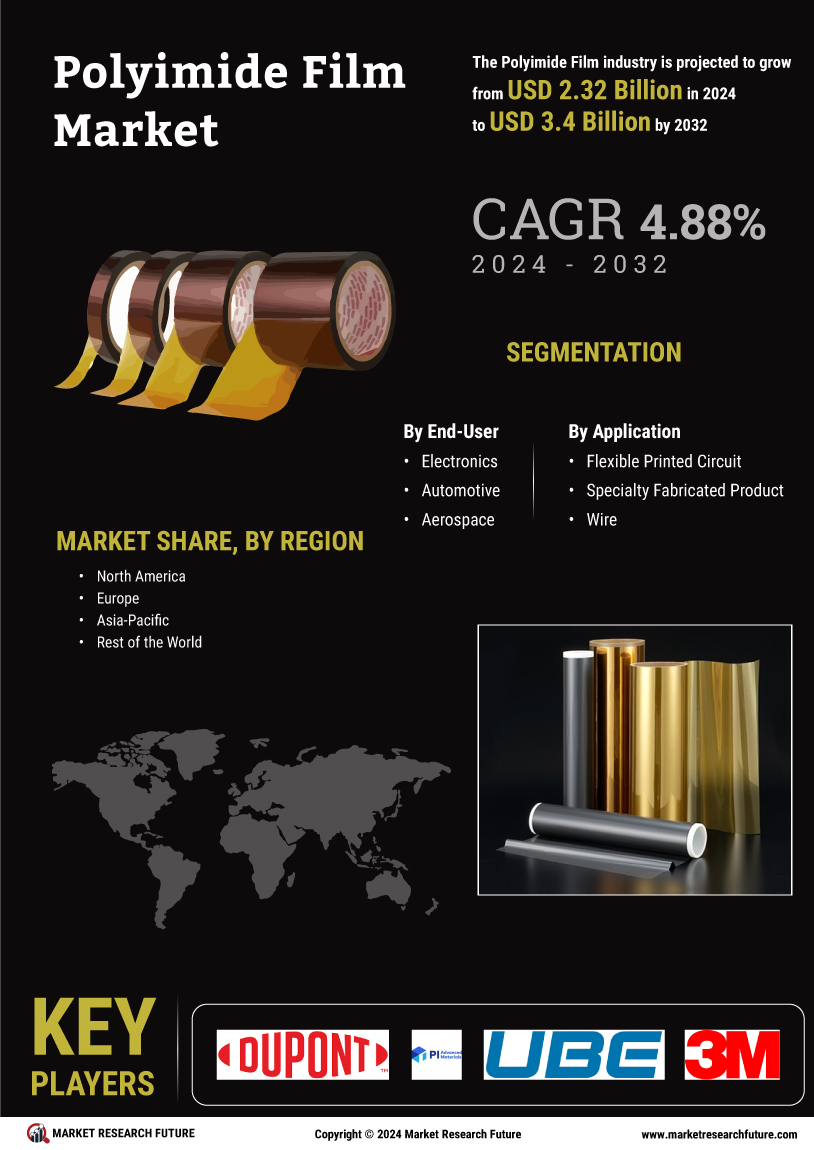

Rising Demand in Electronics

The increasing demand for lightweight and high-performance materials in the electronics sector is a primary driver for the Polyimide Film Market. As electronic devices become more compact and efficient, manufacturers seek materials that can withstand high temperatures and provide excellent electrical insulation. Polyimide films, known for their thermal stability and dielectric properties, are increasingly utilized in flexible printed circuits, insulation for wires, and other electronic components. The market for flexible electronics is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This trend indicates a robust demand for polyimide films, as they are essential in meeting the evolving needs of the electronics industry.

Growth in Aerospace Applications

The aerospace sector's expansion is another critical driver for the Polyimide Film Market. Polyimide films are favored in aerospace applications due to their lightweight nature and ability to endure extreme temperatures and harsh environments. They are utilized in various components, including insulation for wiring and thermal protection systems. The aerospace industry is experiencing a resurgence, with increasing investments in new aircraft and technologies. Reports indicate that the aerospace materials market is expected to reach several billion dollars by the end of the decade, with polyimide films playing a vital role in enhancing performance and safety in aircraft design and manufacturing.

Increased Focus on Renewable Energy

The Polyimide Film Industry positively. Polyimide films are utilized in solar panels and wind turbine components due to their excellent thermal and electrical properties. As countries invest in sustainable energy solutions, the demand for efficient and durable materials in renewable energy applications is likely to rise. The renewable energy market is anticipated to grow at a rapid pace, with solar energy installations expected to double in the next few years. This growth presents a significant opportunity for polyimide films, as they are integral to enhancing the efficiency and longevity of renewable energy technologies.

Advancements in Automotive Technologies

The automotive industry's shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS) is propelling the demand for polyimide films. These films are essential in applications such as insulation for electric wiring and components that require high thermal resistance. As the automotive sector aims for greater efficiency and safety, the need for materials that can withstand high temperatures and provide reliable performance becomes paramount. The automotive market is projected to grow significantly, with electric vehicle sales expected to account for a substantial portion of total vehicle sales in the coming years. This transition indicates a promising outlook for the Polyimide Film Market, as manufacturers increasingly rely on these films to meet new technological demands.

Emerging Applications in Medical Devices

The Polyimide Film Market is also benefiting from the increasing use of polyimide films in medical devices. These films are valued for their biocompatibility, flexibility, and ability to withstand sterilization processes. As the healthcare sector continues to innovate, the demand for advanced medical devices that require reliable and durable materials is on the rise. The medical device market is projected to expand significantly, with estimates suggesting a growth rate of over 5% annually. This trend indicates a growing reliance on polyimide films in applications such as flexible sensors, diagnostic devices, and surgical instruments, further driving the demand within the Polyimide Film Market.