Growing Focus on Energy Efficiency

The increasing focus on energy efficiency is a pivotal driver for the power transmission and distribution equipment market. As businesses and consumers seek to reduce energy consumption and costs, there is a heightened demand for equipment that enhances energy efficiency in power distribution. The US government has implemented various initiatives to promote energy-efficient technologies, which has led to a surge in the adoption of high-efficiency transformers and other power td-equipment. This trend is expected to continue, with energy efficiency standards becoming more stringent, thereby creating opportunities for manufacturers to innovate and expand their offerings in the power td-equipment market.

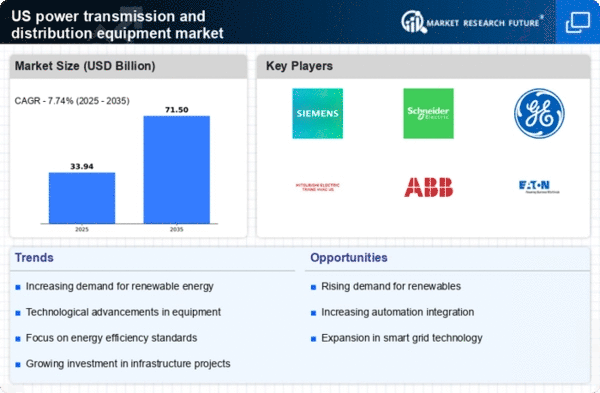

Rising Demand for Renewable Energy

The increasing emphasis on renewable energy sources in the US is driving the power transmission and distribution equipment market. As states implement policies to transition to cleaner energy, the demand for equipment that supports solar, wind, and other renewable technologies is surging. In 2025, renewable energy accounted for approximately 20% of the total energy generation in the US, indicating a significant shift. This trend necessitates advanced power transmission and distribution equipment to manage the integration of these energy sources into the existing grid. Consequently, manufacturers are focusing on developing innovative solutions that enhance efficiency and reliability, thereby propelling growth in the power td-equipment market.

Infrastructure Modernization Initiatives

The US government is actively investing in infrastructure modernization, which is a crucial driver for the power td-equipment market. The Biden administration's infrastructure plan allocates $1.2 trillion for various projects, including upgrades to the electrical grid. This investment aims to enhance the resilience and efficiency of power distribution systems. As aging infrastructure is replaced, there is a growing need for advanced power td-equipment that can support smart grid technologies. The modernization efforts are expected to create a robust demand for transformers, switchgear, and other essential components, thereby stimulating market growth.

Technological Advancements in Smart Grids

Technological advancements in smart grid systems are significantly influencing the power td-equipment market. The integration of digital technologies into power distribution networks enhances operational efficiency and reliability. Smart grids enable real-time monitoring and management of electricity flow, which is essential for accommodating the growing demand for energy. In 2025, it is estimated that smart grid investments in the US will exceed $100 billion, reflecting the industry's commitment to modernization. This shift towards intelligent systems is driving the need for advanced power td-equipment, such as smart meters and automated distribution systems, thereby fostering market growth.

Increased Electrification of Transportation

The electrification of transportation is emerging as a significant driver for the power transmission and distribution equipment market. With the US aiming for 50% of new vehicle sales to be electric by 2030, the demand for charging infrastructure is expected to rise dramatically. This shift necessitates the development of robust power distribution systems to support the increased load on the grid. As electric vehicles (EVs) become more prevalent, utilities are investing in upgrading their power td-equipment to accommodate the anticipated surge in electricity demand. This trend not only supports the growth of the power td-equipment market but also aligns with broader sustainability goals.

Leave a Comment