Advancements in Sensor Technology

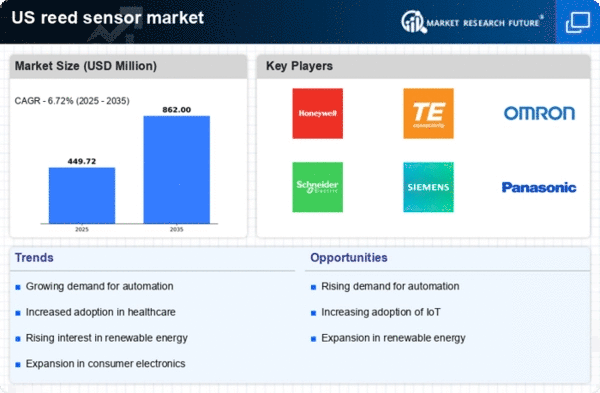

Technological advancements in sensor technology are influencing the reed sensor market positively. Innovations such as miniaturization, improved sensitivity, and enhanced durability are making reed sensors more appealing for a variety of applications. These advancements enable the development of more compact and efficient devices, which can be utilized in diverse sectors, including consumer electronics, healthcare, and industrial applications. The US sensor market is anticipated to grow at a CAGR of around 7% through 2025, indicating a favorable environment for the reed sensor market. This trend suggests that manufacturers who invest in research and development to enhance reed sensor technology may find lucrative opportunities in the evolving market.

Expansion of Automotive Applications

The automotive sector increasingly incorporates reed sensors for various applications, including door and trunk closure detection, as well as position sensing for electric vehicles. The shift towards electric and hybrid vehicles is particularly noteworthy, as these vehicles often utilize reed sensors for battery management systems and other critical functions. The US automotive market is expected to grow at a CAGR of around 5% through 2025, which could lead to heightened demand for reed sensors. This expansion in automotive applications indicates a promising avenue for the reed sensor market, as manufacturers align their products with the evolving needs of the automotive industry.

Rising Adoption of Smart Home Devices

The increasing integration of smart home technologies is driving the growth of the reed sensor market. As consumers seek enhanced convenience and security, the demand for smart devices such as smart locks, lighting systems, and security alarms is on the rise. Reed sensors play a crucial role in these applications, providing reliable and efficient operation. According to recent estimates, the smart home market in the US is projected to reach approximately $100 billion by 2025, indicating a substantial opportunity for the reed sensor market. This trend suggests that manufacturers focusing on developing reed sensors tailored for smart home applications may experience significant growth, as consumers prioritize innovative solutions that enhance their living environments.

Increased Focus on Industrial Automation

The trend towards industrial automation is significantly impacting the reed sensor market. As industries strive for greater efficiency and productivity, the demand for sensors that can provide accurate and reliable data is paramount. Reed sensors are increasingly utilized in manufacturing processes, robotics, and conveyor systems, where they serve as essential components for detecting position and movement. The US industrial automation market is projected to grow by approximately 10% annually, suggesting a robust opportunity for the reed sensor market. This growth indicates that companies investing in automation technologies may increasingly rely on reed sensors to enhance operational efficiency.

Growing Emphasis on Safety and Security Systems

The heightened focus on safety and security in residential and commercial settings is propelling the demand for reed sensors. These sensors are integral to alarm systems, access control, and surveillance applications, providing reliable detection capabilities. With the US security systems market expected to reach $50 billion by 2025, the reed sensor market stands to benefit from this trend. As businesses and homeowners prioritize security measures, the integration of reed sensors into various systems is likely to increase, thereby enhancing the overall market landscape. This emphasis on safety and security suggests a sustained demand for reed sensors in the coming years.