Emerging Geopolitical Tensions

The rockets missiles market is experiencing heightened demand due to emerging geopolitical tensions. Nations are increasingly investing in advanced missile systems to bolster their defense capabilities. The ongoing conflicts and territorial disputes have prompted governments to prioritize military readiness, leading to a projected growth rate of approximately 5.5% annually in the sector. This trend indicates a shift towards modernization and the acquisition of sophisticated technologies, which are essential for maintaining strategic advantages. As countries navigate complex international relations, the rockets missiles market is likely to see sustained investments aimed at enhancing deterrence and response capabilities.

Increased Focus on National Security

In the current climate, there is an increased focus on national security, which is significantly impacting the rockets missiles market. Governments are recognizing the necessity of robust defense mechanisms to counter potential threats. This has led to a surge in funding for missile development programs, with an estimated increase of 10% in defense budgets allocated to missile technology. The emphasis on safeguarding national interests is likely to drive innovation and procurement in the sector, ensuring that the rockets missiles market remains a critical component of defense strategies.

Strategic Partnerships and Alliances

Strategic partnerships and alliances among defense contractors are emerging as a key driver in the rockets missiles market. Collaborations between private companies and government entities facilitate the sharing of resources and expertise, leading to accelerated development of advanced missile systems. These partnerships are essential for addressing the complex challenges of modern warfare. The market is expected to benefit from these synergies, as they enhance research and development capabilities, potentially increasing market competitiveness. As the landscape evolves, the rockets missiles market will likely see more collaborative efforts aimed at innovation and efficiency.

Technological Integration in Defense Systems

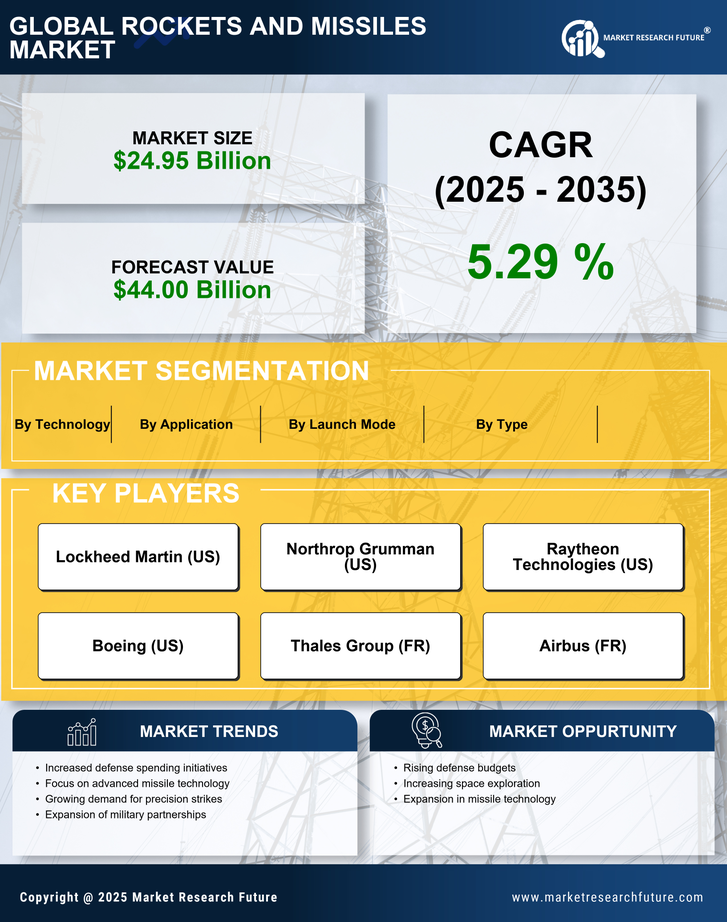

The integration of cutting-edge technologies into defense systems is a pivotal driver for the rockets missiles market. Innovations such as artificial intelligence, machine learning, and advanced materials are transforming missile design and functionality. The market is projected to reach a valuation of $30 billion by 2027, reflecting a compound annual growth rate (CAGR) of 6.2%. These advancements not only improve accuracy and efficiency but also enhance the overall effectiveness of defense strategies. As military forces seek to leverage technology for operational superiority, the rockets missiles market is poised for significant growth.

Growing Demand for Precision-Guided Munitions

The growing demand for precision-guided munitions is reshaping the rockets missiles market. Military operations increasingly require high accuracy to minimize collateral damage and enhance mission success rates. This trend is reflected in the rising investments in smart missile technologies, which are projected to account for over 40% of the total market share by 2026. The emphasis on precision not only improves operational effectiveness but also aligns with international norms regarding the use of force. As a result, the rockets missiles market is likely to expand in response to this demand for more sophisticated and accurate weaponry.