Educational Initiatives and Workshops

is positively influenced by educational initiatives and workshops aimed at promoting sewing skills.. Various organizations and community centers are increasingly offering classes that teach sewing techniques, thereby attracting new enthusiasts to the craft. In 2025, it is anticipated that participation in these workshops will contribute to a 8% increase in sewing machine sales, as individuals who learn to sew often invest in their own machines. This trend not only fosters a new generation of sewers but also enhances the overall perception of sewing as a valuable skill. As educational programs continue to expand, the sewing machines market is likely to benefit from a steady influx of new customers eager to explore their creativity.

Increased Interest in DIY and Crafting

is benefiting from a growing interest in DIY projects and crafting among consumers.. This trend is particularly evident in the United States, where a significant % of the population engages in sewing as a creative outlet. The rise of social media platforms has further fueled this interest, as users share their projects and inspire others to take up sewing. In 2025, the market is expected to see a surge in demand for sewing machines, with an estimated increase of 10% attributed to this DIY culture. As more individuals seek to create personalized items, the sewing machines market is likely to thrive, catering to both beginners and experienced crafters alike.

Technological Advancements in Sewing Machines

is experiencing a notable transformation due to rapid technological advancements.. Innovations such as computerized sewing machines, which offer enhanced precision and a variety of built-in stitches, are becoming increasingly popular among consumers. In 2025, the market for these advanced machines is projected to grow by approximately 15%, driven by the demand for user-friendly features and automation. Furthermore, the integration of smart technology allows for connectivity with mobile applications, enabling users to access tutorials and design patterns easily. This trend not only attracts hobbyists but also professionals seeking efficiency in their work. As a result, the sewing machines market is likely to expand significantly, appealing to a broader audience..

Growth of E-commerce Platforms for Sewing Machines

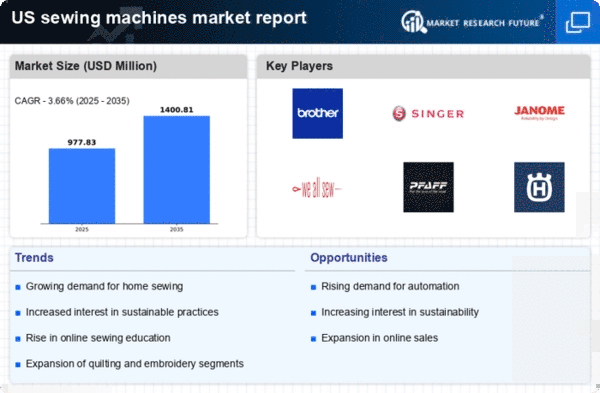

is experiencing a significant shift towards e-commerce platforms., which are becoming the preferred shopping method for many consumers. The convenience of online shopping, coupled with the ability to compare prices and read reviews, is driving this trend. In 2025, it is estimated that online sales of sewing machines will account for over 30% of total market sales, reflecting a growing preference for digital purchasing. This shift is particularly beneficial for niche brands that may not have a physical presence but can reach a wider audience through online channels. As e-commerce continues to expand, the sewing machines market is likely to see increased competition and innovation, ultimately benefiting consumers with a broader range of options.

Rising Demand for Customization and Personalization

is witnessing a shift towards customization and personalization., as consumers increasingly seek unique and tailored products. This trend is particularly pronounced in the fashion industry, where individuals desire to create bespoke garments that reflect their personal style. In 2025, the market is projected to grow by 12%, driven by the demand for machines that facilitate customization, such as those with embroidery capabilities. As consumers become more aware of sustainable fashion practices, the ability to create personalized items from repurposed materials is gaining traction. Consequently, the sewing machines market is likely to expand, offering a range of products that cater to this growing desire for individuality.