Rising Diabetes Prevalence

The increasing prevalence of diabetes in the US is a primary driver for the smart insulin-pens market. According to the Centers for Disease Control and Prevention (CDC), approximately 34.2 million Americans, or 10.5% of the population, have diabetes. This growing patient population necessitates innovative solutions for insulin delivery, thereby propelling the demand for smart insulin pens. These devices offer enhanced features such as dose tracking and integration with mobile applications, which appeal to tech-savvy patients. As diabetes management becomes more complex, the smart insulin-pens market is likely to expand, catering to the needs of a larger demographic. Furthermore, the rising healthcare costs associated with diabetes management underscore the need for efficient and effective insulin delivery systems, further driving market growth.

Supportive Regulatory Environment

A supportive regulatory environment is fostering growth in the smart insulin-pens market. Regulatory bodies in the US are increasingly recognizing the importance of innovative diabetes management solutions. The Food and Drug Administration (FDA) has streamlined the approval process for smart medical devices, encouraging manufacturers to bring new products to market. This regulatory support not only accelerates innovation but also instills confidence in patients and healthcare providers regarding the safety and efficacy of these devices. As a result, the smart insulin-pens market is likely to experience increased investment and development, leading to a wider array of options for consumers. The favorable regulatory landscape is expected to contribute to the market's expansion, making smart insulin pens more accessible to those in need.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is emerging as a key driver for the smart insulin-pens market. Patients are increasingly seeking tailored treatment options that cater to their individual needs and preferences. Smart insulin pens, which can be programmed to deliver specific doses based on a patient's unique insulin requirements, align well with this trend. The ability to customize insulin delivery not only enhances patient satisfaction but also improves adherence to treatment regimens. As healthcare providers recognize the importance of personalized approaches, the smart insulin-pens market is expected to expand. This growth is further supported by advancements in data analytics and artificial intelligence, which enable more precise insulin management tailored to individual patient profiles.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare in the US is driving the smart insulin-pens market. As healthcare systems shift towards preventive measures, patients are encouraged to take a proactive approach to their diabetes management. Smart insulin pens, with their ability to provide real-time data and insights, empower patients to make informed decisions about their health. This trend aligns with the broader healthcare initiative to reduce long-term complications associated with diabetes, which can be costly and detrimental to quality of life. The smart insulin-pens market is likely to benefit from this focus, as more patients seek tools that facilitate better self-management and adherence to treatment plans. Consequently, the market may see an increase in adoption rates among patients who prioritize preventive care.

Technological Advancements in Healthcare

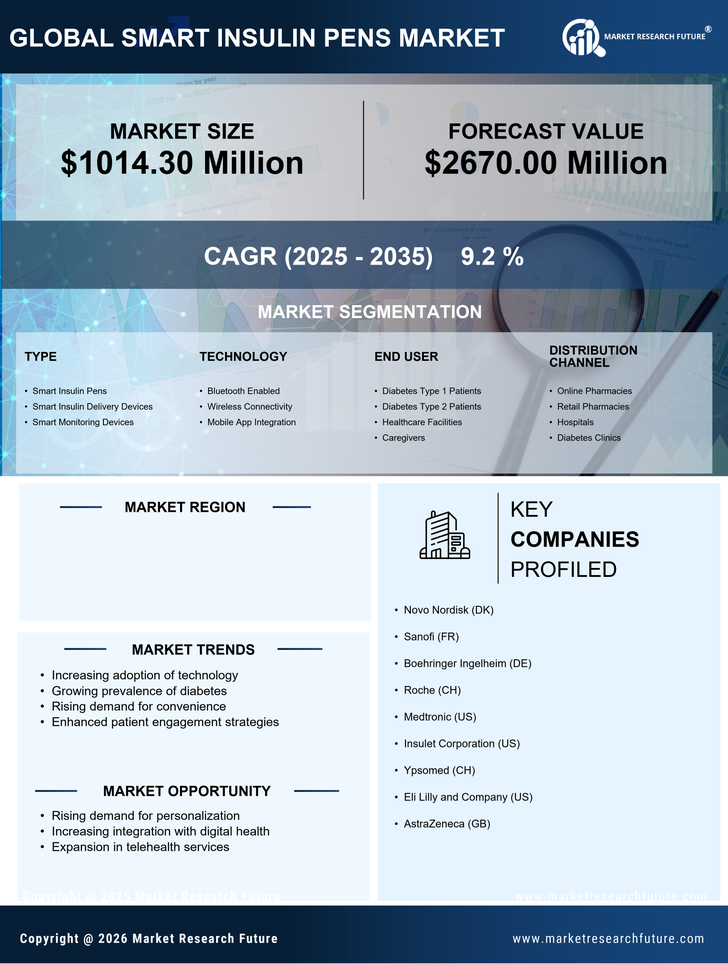

Technological advancements in healthcare are significantly influencing the smart insulin-pens market. Innovations such as Bluetooth connectivity, real-time data sharing, and mobile app integration are transforming how patients manage their diabetes. These technologies allow for better tracking of insulin doses and glucose levels, which can lead to improved health outcomes. The market is projected to grow as more healthcare providers adopt these technologies to enhance patient care. In 2025, the smart insulin-pens market is expected to witness a surge in demand, with estimates suggesting a growth rate of around 15% annually. This trend indicates a shift towards more connected and user-friendly diabetes management solutions, making smart insulin pens an attractive option for patients and healthcare professionals alike.