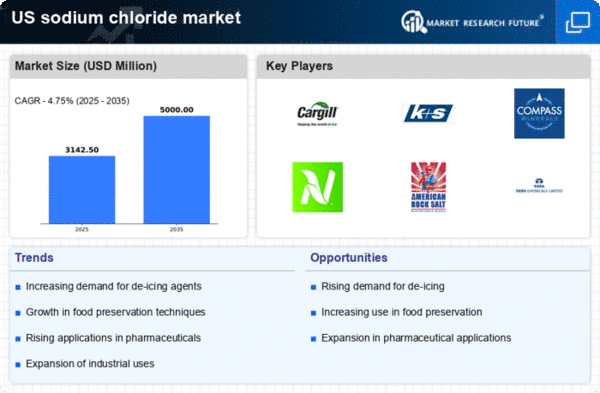

The sodium chloride market exhibits a competitive landscape characterized by a blend of established players and emerging companies, driven by diverse growth factors such as increasing demand in food processing, de-icing applications, and industrial uses. Major companies like Cargill (US), Compass Minerals (US), and K+S AG (DE) are strategically positioned to leverage their operational strengths. Cargill (US) focuses on innovation in product offerings and sustainability initiatives, while Compass Minerals (US) emphasizes its extensive distribution network and operational efficiency. K+S AG (DE) is enhancing its market presence through strategic acquisitions and partnerships, collectively shaping a competitive environment that is increasingly focused on sustainability and technological advancements.Key business tactics within the sodium chloride market include localizing manufacturing and optimizing supply chains to enhance responsiveness to market demands. The market structure appears moderately fragmented, with key players exerting considerable influence over pricing and supply dynamics. This fragmentation allows for niche players to thrive, while larger companies maintain a competitive edge through economies of scale and advanced logistics capabilities.

In October Cargill (US) announced a significant investment in a new production facility aimed at increasing its output of specialty salts. This strategic move is likely to enhance Cargill's ability to meet the growing demand for high-purity sodium chloride in various applications, including food and pharmaceuticals. The investment underscores Cargill's commitment to innovation and its proactive approach to capturing market share in a competitive landscape.

In September Compass Minerals (US) launched a new line of eco-friendly de-icing products, which utilize advanced technology to minimize environmental impact. This initiative not only aligns with current sustainability trends but also positions Compass Minerals as a leader in environmentally responsible solutions within the sodium chloride market. The introduction of these products may attract environmentally conscious consumers and municipalities, thereby expanding their market reach.

In August K+S AG (DE) completed the acquisition of a regional salt producer, enhancing its operational footprint in North America. This acquisition is expected to bolster K+S AG's production capabilities and distribution network, allowing for improved service delivery to customers. The strategic importance of this move lies in K+S AG's ability to leverage synergies from the acquisition, potentially leading to cost reductions and enhanced market competitiveness.

As of November current competitive trends in the sodium chloride market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances among key players are shaping the landscape, fostering innovation and collaborative approaches to market challenges. The shift from price-based competition to a focus on technological advancements and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to innovate and adapt to evolving consumer preferences.