Emergence of New Space Startups

The emergence of new space startups is reshaping the landscape of the space battery market. In recent years, numerous startups have entered the space sector, focusing on innovative technologies and solutions. These companies are often more agile and willing to experiment with novel battery chemistries and designs. As of 2025, it is estimated that over 300 startups are actively engaged in various aspects of space technology, including battery development. This influx of new players is driving competition and encouraging established companies to enhance their offerings. The space battery market is likely to benefit from the fresh perspectives and innovative approaches these startups bring, potentially leading to breakthroughs in battery efficiency, weight reduction, and overall performance.

Growing Focus on Energy Efficiency

The growing focus on energy efficiency is a critical driver for the space battery market. As space missions become more complex and prolonged, the need for energy-efficient solutions is increasingly recognized. In 2025, energy efficiency is projected to be a key criterion for battery selection in space applications, with a focus on reducing weight and maximizing energy density. This trend is particularly relevant for missions that require long-duration power supply, such as deep space exploration. The space battery market is responding to this demand by developing advanced battery technologies that not only enhance energy efficiency but also minimize waste. Innovations in materials and design are likely to play a pivotal role in achieving these goals, ultimately contributing to the sustainability of space missions.

Government Investments in Space Exploration

Government investments in space exploration are significantly influencing the space battery market. The U.S. government has allocated substantial funding for various space missions, including lunar and Martian exploration. In 2025, the budget for NASA's Artemis program alone is estimated at $25 billion, which includes provisions for advanced battery technologies. These investments are aimed at developing batteries that can operate efficiently in harsh extraterrestrial environments. As missions become more ambitious, the demand for high-performance batteries that can endure extreme temperatures and provide reliable power over extended periods is likely to increase. This trend not only stimulates innovation within the space battery market but also encourages collaboration between government agencies and private companies, fostering a dynamic ecosystem for battery development.

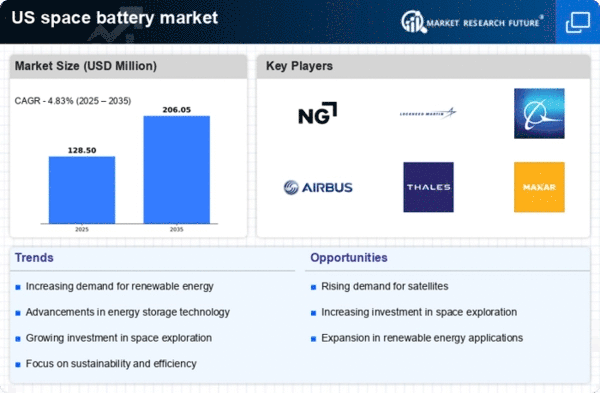

Increased Demand for Satellite Applications

The space battery market is experiencing heightened demand due to the proliferation of satellite applications. As the number of satellites in orbit continues to rise, the need for reliable and efficient power sources becomes paramount. In 2025, the number of operational satellites is projected to exceed 10,000, necessitating advanced battery solutions to support their functionality. This surge in satellite deployment is driven by various sectors, including telecommunications, Earth observation, and scientific research. Consequently, manufacturers in the space battery market are focusing on developing batteries that can withstand extreme conditions while providing long-lasting energy. The increasing reliance on satellite technology for communication and data collection further underscores the importance of robust battery systems, positioning the space battery market for substantial growth in the coming years.

Technological Advancements in Energy Storage

Technological advancements in energy storage are propelling the space battery market forward. Innovations in battery chemistry, such as solid-state batteries and lithium-sulfur technologies, are gaining traction due to their potential to offer higher energy densities and improved safety. In 2025, the market is witnessing a shift towards these advanced technologies, which promise to enhance the performance of batteries used in space applications. The development of batteries that can operate effectively in extreme conditions is crucial for the success of long-term space missions. As research and development efforts intensify, the space battery market is likely to see a wave of new products that meet the rigorous demands of space exploration, thereby fostering growth and innovation.