Increased Focus on Energy Efficiency

The traction transformer market is experiencing a heightened focus on energy efficiency, driven by both economic and environmental considerations. As energy costs continue to rise, rail operators are seeking ways to reduce operational expenses, making energy-efficient traction transformers a priority. Additionally, the push for sustainability is prompting stakeholders to invest in technologies that minimize energy consumption and carbon footprints. The traction transformer market is responding to this demand by offering products that comply with stringent energy efficiency standards. This trend not only supports the financial viability of rail operations but also aligns with broader environmental objectives, positioning the market for sustained growth.

Regulatory Support for Electrification

The traction transformer market is positively influenced by regulatory frameworks that support the electrification of transportation systems. Various federal and state policies are being implemented to promote cleaner energy sources and reduce greenhouse gas emissions. For instance, the Federal Railroad Administration has introduced guidelines that encourage the adoption of electric trains, which in turn drives the demand for traction transformers. This regulatory support is expected to enhance the market landscape, as it creates a conducive environment for investments in electrification projects. The traction transformer market is likely to see increased activity as stakeholders align their strategies with these regulations, fostering innovation and growth.

Infrastructure Investments and Upgrades

Significant investments in rail infrastructure across the United States are propelling the traction transformer market forward. Federal and state governments are allocating substantial budgets for the modernization of rail networks, which includes upgrading existing traction transformers. The Infrastructure Investment and Jobs Act has earmarked billions for rail improvements, indicating a robust commitment to enhancing transportation systems. This influx of funding is likely to stimulate demand for advanced traction transformers that can support higher voltage levels and improved energy efficiency. The traction transformer market stands to gain from these infrastructure upgrades, as they create opportunities for manufacturers to supply innovative solutions that meet the evolving needs of the rail sector.

Growing Demand for Electrified Transportation

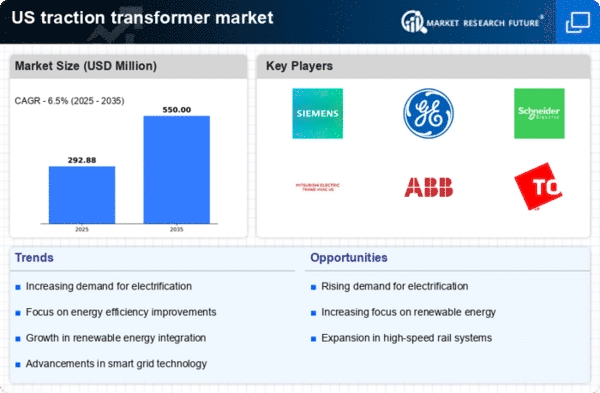

The traction transformer market experiences a notable surge in demand due to the increasing adoption of electrified transportation systems across the United States. As cities and states prioritize the transition to electric trains and trams, the need for efficient and reliable traction transformers becomes paramount. The market is projected to grow at a CAGR of approximately 6.5% from 2025 to 2030, driven by investments in rail infrastructure and electrification projects. This trend indicates a shift towards sustainable transport solutions, which necessitates advanced traction transformers to ensure optimal performance and energy efficiency. The traction transformer market is thus positioned to benefit significantly from this growing demand, as stakeholders seek to enhance the reliability and efficiency of electrified transport systems.

Technological Innovations in Transformer Design

Innovations in transformer design are reshaping the traction transformer market, as manufacturers strive to develop more efficient and compact solutions. Advances in materials science and engineering are enabling the production of traction transformers that offer improved thermal management and energy efficiency. These technological innovations are crucial for meeting the demands of modern rail systems, which require transformers that can operate at higher capacities while minimizing energy losses. The traction transformer market is thus witnessing a shift towards smarter, more efficient designs that not only enhance performance but also contribute to sustainability goals. This trend is likely to attract investments and drive competition among manufacturers.