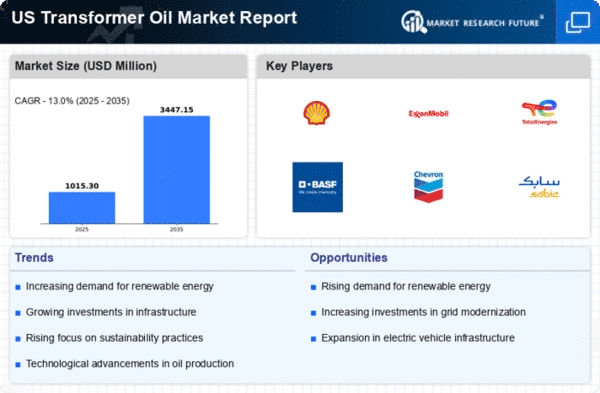

The transformer oil market exhibits a competitive landscape characterized by a blend of established players and emerging companies, driven by the increasing demand for energy-efficient solutions and the growing emphasis on sustainability. Key players such as Shell (GB), ExxonMobil (US), and TotalEnergies (FR) are strategically positioned to leverage their extensive research and development capabilities, focusing on innovation and product differentiation. These companies are actively pursuing partnerships and collaborations to enhance their market presence, thereby shaping a competitive environment that is both dynamic and multifaceted.In terms of business tactics, companies are increasingly localizing manufacturing to reduce operational costs and enhance supply chain efficiency. The market structure appears moderately fragmented, with several key players holding substantial market shares. This fragmentation allows for a diverse range of products and services, fostering competition that drives innovation and customer-centric solutions.

In October ExxonMobil (US) announced a significant investment in a new facility dedicated to the production of bio-based transformer oils. This strategic move is indicative of the company's commitment to sustainability and aligns with the growing trend towards environmentally friendly products. The establishment of this facility is expected to enhance ExxonMobil's competitive edge by catering to the rising demand for sustainable transformer oils, thereby positioning the company favorably in the market.

In September TotalEnergies (FR) launched a new line of high-performance transformer oils designed to improve energy efficiency and reduce environmental impact. This initiative reflects TotalEnergies' focus on innovation and its strategic intent to lead in the sustainable energy sector. By introducing these advanced products, the company aims to capture a larger market share while addressing the increasing regulatory pressures for greener solutions.

In August Shell (GB) entered into a strategic partnership with a leading technology firm to develop AI-driven solutions for optimizing transformer oil performance. This collaboration is poised to enhance Shell's product offerings and improve operational efficiencies. The integration of AI technology is likely to provide Shell with a competitive advantage, enabling the company to offer tailored solutions that meet the evolving needs of its customers.

As of November the competitive trends in the transformer oil market are increasingly defined by digitalization, sustainability, and technological integration. Strategic alliances are becoming pivotal in shaping the landscape, as companies seek to enhance their capabilities and market reach. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to deliver sustainable and technologically advanced solutions.