Growing Awareness and Education

The US Urology Devices Market is bolstered by increasing awareness and education regarding urological health. Campaigns aimed at destigmatizing urological disorders have led to more individuals seeking medical advice and treatment. Organizations such as the American Urological Association provide resources and information, empowering patients to understand their conditions better. This heightened awareness translates into a greater demand for urology devices, as patients are more likely to pursue treatment options. Moreover, educational initiatives targeting healthcare professionals ensure that they are well-informed about the latest advancements in urology devices, further driving market growth as they recommend these solutions to their patients.

Government Initiatives and Funding

The US Urology Devices Market benefits from various government initiatives aimed at improving healthcare access and quality. Federal programs, such as the National Institutes of Health funding for urological research, play a crucial role in advancing the development of new devices and treatment modalities. Additionally, policies promoting preventive care and early diagnosis contribute to increased awareness and utilization of urology devices. The Centers for Medicare & Medicaid Services also support reimbursement for innovative urological treatments, further incentivizing healthcare providers to adopt advanced technologies. This supportive regulatory environment fosters growth in the urology devices market, encouraging investment and innovation.

Rising Prevalence of Urological Disorders

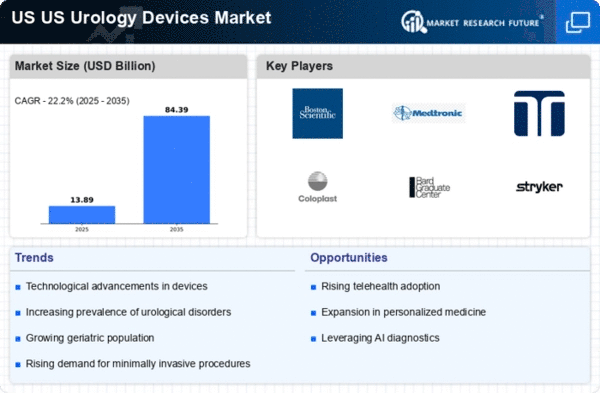

The US Urology Devices Market is experiencing growth due to the increasing prevalence of urological disorders such as urinary incontinence, benign prostatic hyperplasia, and kidney stones. According to the National Institute of Diabetes and Digestive and Kidney Diseases, millions of Americans are affected by these conditions, leading to a heightened demand for effective treatment options. This surge in patient numbers necessitates the development and adoption of advanced urology devices, which are essential for diagnosis and management. As healthcare providers seek to improve patient outcomes, the market is likely to expand, driven by the need for innovative solutions that address these prevalent health issues.

Technological Innovations in Urology Devices

The US Urology Devices Market is significantly influenced by rapid technological advancements. Innovations such as minimally invasive surgical techniques, robotic-assisted surgeries, and advanced imaging technologies are transforming the landscape of urological care. For instance, the introduction of laser lithotripsy devices has revolutionized the treatment of kidney stones, offering patients quicker recovery times and reduced complications. Furthermore, the integration of artificial intelligence in diagnostic tools enhances accuracy and efficiency in identifying urological conditions. These technological breakthroughs not only improve patient care but also stimulate market growth as healthcare facilities invest in state-of-the-art urology devices to remain competitive.

Aging Population and Increased Healthcare Demand

The US Urology Devices Market is significantly impacted by the aging population, which is more susceptible to urological disorders. As the baby boomer generation continues to age, the demand for urology devices is expected to rise sharply. According to the U.S. Census Bureau, the number of individuals aged 65 and older is projected to double by 2060, leading to an increased prevalence of conditions such as prostate cancer and urinary incontinence. This demographic shift necessitates the development and availability of specialized urology devices to cater to the unique needs of older adults. Consequently, manufacturers are likely to focus on creating innovative solutions that address the challenges faced by this growing population.