Regulatory Support and Standards

The US Veterinary Ultrasound Market is benefiting from enhanced regulatory support and the establishment of standards that promote the safe and effective use of ultrasound technology in veterinary practices. Regulatory bodies are increasingly recognizing the importance of ultrasound as a diagnostic tool, leading to the development of guidelines that ensure quality and safety in its application. This regulatory framework not only fosters trust among pet owners but also encourages veterinary professionals to adopt ultrasound technology in their practices. As compliance with these standards becomes more prevalent, the market is likely to see an uptick in the adoption of ultrasound equipment, as veterinarians seek to align with best practices. This supportive regulatory environment is expected to contribute positively to the growth trajectory of the veterinary ultrasound market.

Rising Pet Ownership and Spending

The US Veterinary Ultrasound Market is significantly influenced by the rising pet ownership rates and the corresponding increase in spending on pet healthcare. As more households adopt pets, particularly dogs and cats, the demand for veterinary services, including ultrasound diagnostics, is likely to rise. According to recent statistics, pet ownership in the United States has reached approximately 70% of households, leading to a surge in the number of veterinary clinics and services available. Additionally, pet owners are increasingly willing to spend on advanced medical treatments, including ultrasound, to ensure the well-being of their animals. This trend is expected to drive the growth of the veterinary ultrasound market, as more clinics invest in state-of-the-art ultrasound equipment to meet the needs of their clientele.

Increased Focus on Preventive Care

The US Veterinary Ultrasound Market is witnessing a paradigm shift towards preventive care, which is reshaping the demand for ultrasound services. As pet owners become more aware of the importance of regular health check-ups, veterinarians are increasingly utilizing ultrasound as a non-invasive diagnostic tool to detect potential health issues early. This proactive approach not only enhances the quality of care but also reduces long-term treatment costs for pet owners. The rising trend of pet insurance is further supporting this shift, as more owners are willing to invest in preventive measures. Consequently, the market for veterinary ultrasound is expected to expand, with an increasing number of veterinary clinics incorporating ultrasound technology into their routine examinations. This trend suggests a growing recognition of the value of preventive care in maintaining pet health.

Technological Advancements in Imaging

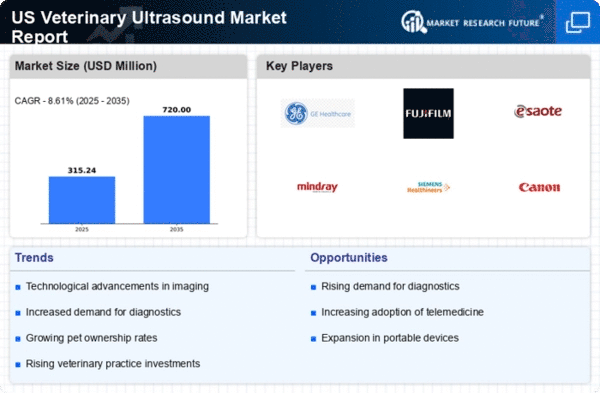

The US Veterinary Ultrasound Market is experiencing a notable transformation due to rapid technological advancements in imaging techniques. Innovations such as 3D and 4D ultrasound imaging are enhancing diagnostic capabilities, allowing veterinarians to obtain more detailed and accurate images of animal anatomy. This is particularly beneficial for complex cases, where precise imaging is crucial for effective treatment. The integration of artificial intelligence in ultrasound devices is also streamlining the diagnostic process, potentially reducing the time required for interpretation. As a result, the demand for advanced ultrasound equipment is likely to increase, reflecting a shift towards more sophisticated veterinary practices. The market for veterinary ultrasound equipment is projected to grow at a compound annual growth rate of approximately 6.5% over the next few years, indicating a robust expansion driven by these technological innovations.

Educational Initiatives and Training Programs

The US Veterinary Ultrasound Market is also being propelled by educational initiatives and training programs aimed at enhancing the skills of veterinary professionals in ultrasound technology. As the complexity of veterinary care increases, there is a growing need for veterinarians to be proficient in advanced diagnostic techniques, including ultrasound. Various organizations and institutions are offering specialized training programs that equip veterinarians with the necessary skills to effectively utilize ultrasound in their practices. This emphasis on education not only improves diagnostic accuracy but also boosts the confidence of veterinary professionals in employing ultrasound technology. As more veterinarians become trained in ultrasound techniques, the demand for ultrasound services is likely to rise, further driving the growth of the veterinary ultrasound market.