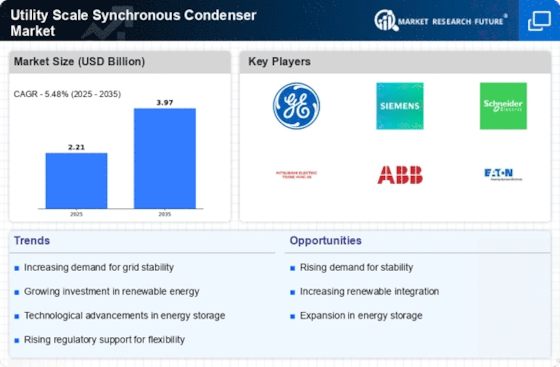

Technological Innovations in Energy Storage

Technological advancements in energy storage systems are significantly influencing the Utility Scale Synchronous Condenser Market. Innovations such as enhanced battery technologies and hybrid systems that combine synchronous condensers with energy storage solutions are emerging. These advancements allow for improved energy management and grid reliability. For instance, the integration of synchronous condensers with lithium-ion batteries can provide both reactive power support and energy storage capabilities, addressing the dual challenges of grid stability and energy supply. The market for energy storage is expected to grow at a compound annual growth rate of over 20% in the coming years, further driving the demand for synchronous condensers as a complementary technology. This synergy between energy storage and synchronous condensers is likely to shape the future landscape of the Utility Scale Synchronous Condenser Market.

Rising Investments in Infrastructure Development

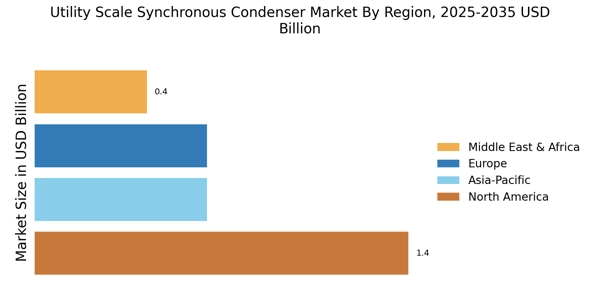

The Utility Scale Synchronous Condenser Market is poised for growth due to rising investments in infrastructure development across various regions. As countries upgrade their electrical grids to accommodate increasing energy demands and integrate renewable sources, the need for synchronous condensers becomes critical. Infrastructure projects aimed at enhancing grid reliability and capacity are being prioritized, with significant funding allocated for modernization efforts. For instance, recent reports indicate that investments in grid infrastructure are expected to exceed several billion dollars over the next decade. This influx of capital is likely to create opportunities for the Utility Scale Synchronous Condenser Market, as utilities seek to deploy advanced technologies that ensure a stable and resilient power supply.

Increased Demand for Renewable Energy Integration

The Utility Scale Synchronous Condenser Market is experiencing heightened demand due to the increasing integration of renewable energy sources into the power grid. As countries strive to meet ambitious renewable energy targets, the need for grid stability becomes paramount. Synchronous condensers play a crucial role in providing reactive power support, which is essential for maintaining voltage levels and ensuring reliable electricity supply. According to recent data, the share of renewables in the energy mix is projected to reach 50% by 2030, necessitating advanced technologies like synchronous condensers to manage grid fluctuations. This trend indicates a robust growth trajectory for the Utility Scale Synchronous Condenser Market, as utilities and grid operators seek solutions to accommodate the variability of renewable energy generation.

Regulatory Frameworks Supporting Grid Modernization

The Utility Scale Synchronous Condenser Market is benefiting from evolving regulatory frameworks that emphasize grid modernization and resilience. Governments are increasingly recognizing the importance of maintaining a stable and reliable power grid, particularly as the energy landscape shifts towards more decentralized and renewable sources. Policies that incentivize the deployment of synchronous condensers are being introduced, which may include financial support, tax incentives, and streamlined permitting processes. For example, recent legislation in several regions mandates the installation of reactive power resources to enhance grid reliability. This regulatory support is expected to catalyze investments in synchronous condenser technologies, thereby propelling the growth of the Utility Scale Synchronous Condenser Market in the coming years.

Growing Focus on Energy Efficiency and Sustainability

The Utility Scale Synchronous Condenser Market is increasingly influenced by the global focus on energy efficiency and sustainability. As organizations and governments aim to reduce carbon footprints and enhance energy efficiency, the role of synchronous condensers becomes more pronounced. These systems not only support grid stability but also contribute to overall energy savings by optimizing power factor and reducing losses in transmission. The International Energy Agency has reported that improving energy efficiency could lead to a reduction of up to 40% in global energy demand by 2040. This growing emphasis on sustainability is likely to drive investments in technologies that support efficient energy use, including synchronous condensers, thereby fostering growth in the Utility Scale Synchronous Condenser Market.

.png)