Regulatory Compliance

Regulatory compliance is becoming increasingly stringent across various industries, driving the demand for the Global Vibration Control System Market Industry. Governments and regulatory bodies are implementing standards to minimize noise and vibration pollution, particularly in sectors such as construction, transportation, and manufacturing. Companies are compelled to invest in vibration control systems to meet these regulations and avoid penalties. This trend is expected to contribute to the market's growth, as organizations recognize that compliance not only mitigates legal risks but also enhances their reputation and operational sustainability.

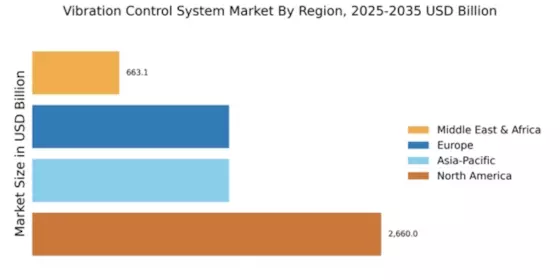

Market Growth Projections

The Global Vibration Control System Market Industry is projected to experience substantial growth over the next decade. With an anticipated market size of 5323.1 USD Billion in 2024, it is expected to reach 11809.2 USD Billion by 2035, reflecting a compound annual growth rate of 7.51% from 2025 to 2035. This growth trajectory suggests a robust demand for vibration control solutions across various sectors, driven by technological advancements, regulatory pressures, and increasing industrial automation.

Technological Advancements

The Global Vibration Control System Market Industry is experiencing rapid technological advancements, which are enhancing the efficiency and effectiveness of vibration control solutions. Innovations in materials and design, such as the development of smart materials and active control systems, are enabling more precise vibration management. For instance, the integration of IoT technology allows for real-time monitoring and adjustment of vibration levels, thereby improving system performance. This trend is likely to drive market growth as industries increasingly adopt advanced vibration control systems to enhance operational efficiency and reduce maintenance costs.

Growing Industrial Automation

The rise of industrial automation is a key driver for the Global Vibration Control System Market Industry. As industries seek to optimize production processes, the demand for vibration control systems is increasing. Automation technologies, including robotics and automated machinery, often generate significant vibrations that can affect product quality and equipment longevity. By implementing effective vibration control systems, companies can mitigate these effects, leading to improved operational efficiency. The market is projected to grow from 5323.1 USD Billion in 2024 to 11809.2 USD Billion by 2035, reflecting a growing recognition of the importance of vibration control in automated environments.

Rising Infrastructure Development

The ongoing global infrastructure development initiatives are significantly influencing the Global Vibration Control System Market Industry. With urbanization and population growth, there is an increasing need for robust infrastructure, including bridges, roads, and buildings. These structures are often subjected to dynamic loads that can induce vibrations, necessitating effective vibration control solutions. The market is likely to benefit from substantial investments in infrastructure projects worldwide, as stakeholders prioritize the safety and longevity of structures. This trend is expected to sustain market growth, particularly in emerging economies where infrastructure development is accelerating.

Increased Awareness of Vibration Effects

There is a growing awareness of the detrimental effects of vibrations on both human health and equipment performance, which is propelling the Global Vibration Control System Market Industry. Industries are recognizing that excessive vibrations can lead to worker discomfort, decreased productivity, and increased maintenance costs. As a result, organizations are increasingly investing in vibration control systems to enhance workplace safety and operational efficiency. This heightened awareness is likely to drive market demand, as companies seek to implement solutions that not only comply with regulations but also promote a healthier work environment.