Rising Export Opportunities

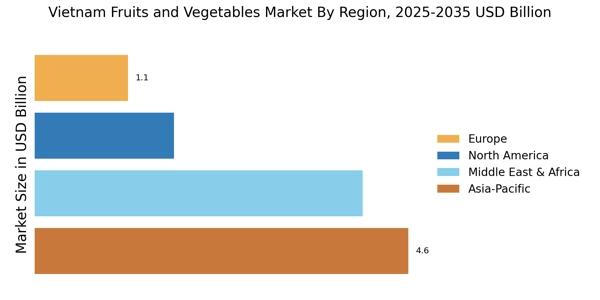

The Vietnam Fruits and Vegetables Market is witnessing a surge in export opportunities, driven by increasing global demand for fresh produce. Countries are increasingly seeking high-quality fruits and vegetables, and Vietnam's favorable climate allows for the cultivation of a diverse range of products. In 2025, the export value of fruits and vegetables is anticipated to reach USD 3.5 billion, reflecting a growing recognition of Vietnam as a key supplier in the international market. This trend is likely to encourage local farmers to adopt better farming practices and invest in quality improvements, thereby enhancing the overall competitiveness of the Vietnam Fruits and Vegetables Market. As export channels expand, the market may experience further growth, benefiting both producers and consumers alike.

Increasing Health Consciousness

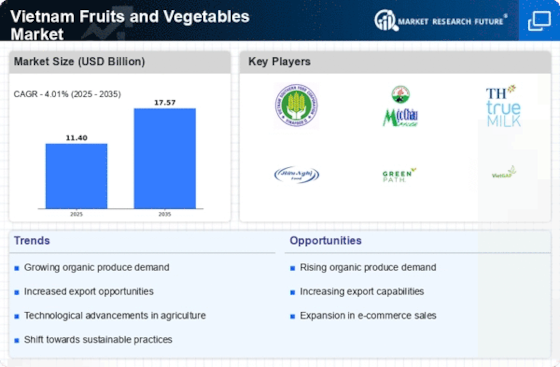

The growing awareness of health and wellness among consumers appears to be a pivotal driver for the Vietnam Fruits and Vegetables Market. As individuals become more informed about the nutritional benefits of fruits and vegetables, there is a noticeable shift towards incorporating these items into daily diets. This trend is reflected in the rising demand for fresh produce, with the market for fruits and vegetables projected to reach approximately USD 12 billion by 2025. Consumers are increasingly seeking organic and locally sourced options, which further fuels the growth of the Vietnam Fruits and Vegetables Market. Retailers are responding by expanding their offerings of fresh produce, thereby enhancing accessibility and variety for consumers. This heightened focus on health is likely to continue influencing purchasing behaviors, suggesting a sustained upward trajectory for the market.

Urbanization and Changing Lifestyles

Urbanization in Vietnam is rapidly transforming lifestyles, which in turn impacts the Vietnam Fruits and Vegetables Market. As more individuals migrate to urban areas, there is a growing demand for convenient and ready-to-eat food options. This shift has led to an increase in the consumption of fresh fruits and vegetables, as urban dwellers seek healthier alternatives to processed foods. The market is adapting to these changes by offering pre-packaged and ready-to-eat produce, catering to the busy lifestyles of city residents. Furthermore, the urban population is projected to reach 50% by 2030, indicating a substantial potential for growth in the Vietnam Fruits and Vegetables Market. This urban-centric demand may drive innovation in packaging and distribution, ensuring that fresh produce remains accessible to consumers in metropolitan areas.

Technological Advancements in Agriculture

Technological advancements in agriculture are poised to revolutionize the Vietnam Fruits and Vegetables Market. Innovations such as precision farming, hydroponics, and smart irrigation systems are being increasingly adopted by farmers to enhance productivity and sustainability. These technologies not only improve crop yields but also reduce resource consumption, aligning with the growing emphasis on environmental sustainability. The integration of technology in farming practices is expected to attract investments and improve the overall efficiency of the agricultural sector. As a result, the Vietnam Fruits and Vegetables Market may experience a transformation, with higher quality produce becoming available to consumers. This shift could potentially lead to increased market share for technologically advanced farms, thereby reshaping the competitive landscape of the industry.

Government Support and Agricultural Policies

Government initiatives aimed at enhancing agricultural productivity and sustainability are likely to play a crucial role in the Vietnam Fruits and Vegetables Market. Policies promoting modern farming techniques, investment in agricultural technology, and support for farmers are expected to bolster production capabilities. The Vietnamese government has set ambitious targets to increase the export value of fruits and vegetables, aiming for USD 3.5 billion by 2025. Such support not only enhances the quality and quantity of produce available in the domestic market but also positions Vietnam as a competitive player in international markets. This proactive approach by the government may lead to improved supply chains and better market access for local farmers, thereby fostering growth within the Vietnam Fruits and Vegetables Market.