Market Share

Introduction: Harnessing the Future of Waste to Energy

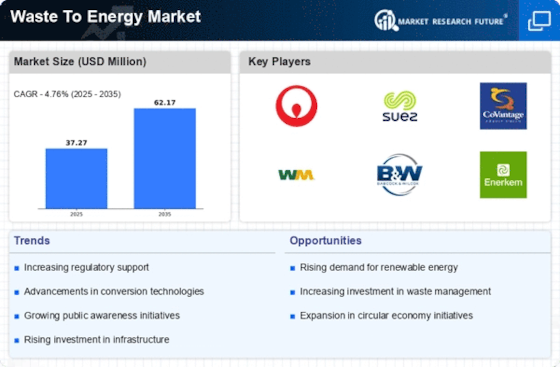

Waste to Energy is accelerating towards a new era. Its momentum is being shaped by the rapid technological development, the evolving regulatory framework, and the heightened demand for the environment. The leading players, the equipment suppliers, the IT integrators and the waste-to-energy plants, are deploying the latest digital tools to optimize their operations and enhance their waste-to-energy capabilities. Disruptors, especially the newcomers focusing on green and biometrics, are challenging the established models and reshaping the market. Opportunities are particularly promising in North America and Europe, where strategic trends are increasingly aligned with government incentives and public-private partnerships aimed at reducing carbon footprints. The ability to differentiate based on technology will be the key to winning share and sustaining growth.

Competitive Positioning

Full-Suite Integrators

These vendors provide comprehensive solutions encompassing design, engineering, and operational management for waste-to-energy projects.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Veolia | Global leader in environmental services | Integrated waste management solutions | Global |

| Babcock & Wilcox | Expertise in energy generation technologies | Waste-to-energy systems | North America, Europe |

Specialized Technology Vendors

These companies focus on innovative technologies and processes that enhance waste conversion efficiency and energy recovery.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| BLUEFIRE Renewables | Proprietary gasification technology | Advanced waste conversion | North America |

| BTA International GMBH | Specialized in organic waste treatment | Anaerobic digestion technology | Europe, Asia |

| GEOCYCLE | Strong ties with cement industry | Waste-derived fuels | Global |

Infrastructure & Equipment Providers

These vendors supply essential equipment and infrastructure necessary for the construction and operation of waste-to-energy facilities.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Ramboll | Integrated engineering and consultancy | Environmental infrastructure | Europe, Asia |

| Viridor | Strong operational capabilities | Waste management and energy recovery | UK |

| Emery Energy Company | Focus on renewable energy solutions | Waste-to-energy systems | North America |

| VLS Environmental Solutions | Innovative waste processing technologies | Waste management solutions | North America |

| KANADEVIA Inova | Cutting-edge waste treatment technologies | Waste-to-energy solutions | Europe |

| REWORLD | Focus on sustainable energy solutions | Waste-to-energy projects | Europe |

| AXPO Holding Ag | Strong energy market presence | Energy production from waste | Switzerland, Europe |

| Biogen | Leader in anaerobic digestion | Biogas production | UK |

| Arrow Ecology | Focus on ecological waste solutions | Waste-to-energy technologies | North America |

Emerging Players & Regional Champions

- ENERGEM (CANADA) – specializes in the conversion of non-recyclable waste into biofuels and chemicals. It recently won a contract with a major city for a new biofuel plant, which competes with the established suppliers by offering a more sustainable alternative to incineration.

- Wastefuel (USA): This company converts solid municipal waste into biogas. It has recently been working with several communities to build new plants. It complements existing suppliers by providing a cleaner energy source and reducing reliance on land filling.

- Greenbacker Capital, from the United States, invests in waste-to-energy projects, and recently announced a partnership for a large-scale anaerobic digestion plant. It is a major challenger to established players, focusing on financing and scaling up waste-to-energy solutions.

- Bioenergy Infrastructure Group (UK): Develops and operates waste-to-energy plants, recently completed a new facility in Scotland, complements established vendors by enhancing local energy security and reducing carbon emissions.

- Suez Recovery and Recycling (Europe): Provides advanced solutions in waste-to-energy, has expanded its activities in several European countries, is redefining waste management by integrating energy recovery in waste processing.

Regional Trends: In 2025, waste-to-energy technology, especially in North America and Europe, is a growing concern, driven by stricter regulations on waste management and a growing concern for the environment. Using advanced thermal treatment methods and anaerobic digestion, the technology focuses on integrating the production of biogas into the waste-to-energy system.

Collaborations & M&A Movements

- In the early part of 2025, Veolia and Suez announced their merger to become the leading company in the waste-to-energy sector. Their aim was to take advantage of economies of scale to further increase their market share, in the face of increasing pressure from governments for more sustainable waste management.

- Waste Management and Covanta, to develop the advanced waste-to-energy plants in the United States, will be concentrating on reducing the waste going to the land fill and on improving the energy yields, thus strengthening their position in the market for renewable energy.

- Engie and Siemens formed a collaboration to integrate smart grid technologies with waste-to-energy plants, enhancing energy efficiency and reliability, which is crucial for meeting the growing demand for sustainable energy solutions.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Conversion Technology | Veolia, Covanta | Veolia utilizes advanced gasification technology, enhancing efficiency in converting waste to energy. Covanta has a strong track record with its mass burn incineration facilities, demonstrating high operational reliability and energy output. |

| Sustainability Practices | SUEZ, Babcock & Wilcox | SUEZ focuses on circular economy principles, integrating waste management with energy recovery. Babcock & Wilcox emphasizes sustainable design in its WTE plants, showcasing projects that significantly reduce carbon footprints. |

| Operational Efficiency | Hitachi Zosen Inova, Enerkem | Hitachi Zosen Inova has implemented AI-driven operational management systems that optimize energy production. Enerkem's innovative biofuel production from waste demonstrates high efficiency and scalability. |

| Regulatory Compliance | Waste Management Inc., RWE | Waste Management Inc. has established robust compliance frameworks that align with evolving environmental regulations. RWE's proactive engagement with regulatory bodies ensures its projects meet stringent standards. |

| Community Engagement | Green Energy Technologies, Renewi | Green Energy Technologies actively involves local communities in project planning, enhancing public acceptance. Renewi's educational initiatives on waste management foster community support and participation. |

Conclusion: Navigating the Waste To Energy Landscape

As we approach 2025, the waste-to-energy market is characterised by a high degree of competition and considerable fragmentation. Both the established players and the newcomers are fighting for a share of the market. The focus of the regional trends is on compliance with regulatory requirements and on sustainable development, which is forcing the suppliers to keep up to date with the innovations and to adjust their strategies accordingly. The established players are able to draw on their existing structures, and they are also able to take advantage of the new possibilities offered by artificial intelligence and automation in order to increase their operational efficiency. The newcomers are concentrating on flexibility and sustainable development in order to gain a foothold in the overcrowded market. The market leaders will be those who are able to take advantage of the opportunities offered by artificial intelligence in order to produce a plethora of new data, to automate their operations in order to reduce their operating costs and to continue to adhere to sustainable development principles. These are the key capabilities that will help the decision-makers to adapt to the changing circumstances and to seize the opportunities offered by the emerging trends.

Leave a Comment