Global Trade Dynamics

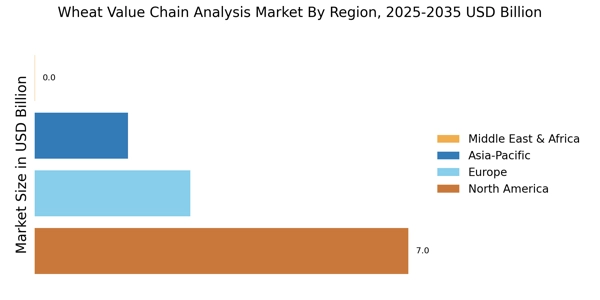

The dynamics of The Wheat Value Chain Analysis Industry. Trade agreements and tariffs can significantly influence wheat prices and availability in various regions. In 2025, it is projected that wheat exports will account for over 20% of total production, highlighting the importance of international markets. Changes in trade policies, such as the introduction of tariffs or export restrictions, can create volatility in the market, affecting both producers and consumers. Additionally, geopolitical factors may further complicate trade relationships, necessitating adaptability within the Wheat Value Chain Analysis Market. Stakeholders must remain vigilant and responsive to these changes to navigate the complexities of The Wheat Value Chain Analysis Market effectively.

Government Policies and Support

Government policies and support mechanisms are crucial drivers of the Wheat Value Chain Analysis Market. Many countries are implementing favorable policies to boost wheat production and ensure food security. For example, subsidies for wheat farmers and investments in agricultural infrastructure are common strategies employed to enhance productivity. In 2025, it is anticipated that government funding for agricultural research will exceed $10 billion, aimed at improving wheat varieties and farming techniques. Such initiatives not only bolster the Wheat Value Chain Analysis Market but also encourage sustainable practices among producers. The alignment of government objectives with market needs is likely to foster a more resilient and competitive wheat sector, ultimately benefiting consumers and stakeholders alike.

Increasing Demand for Wheat Products

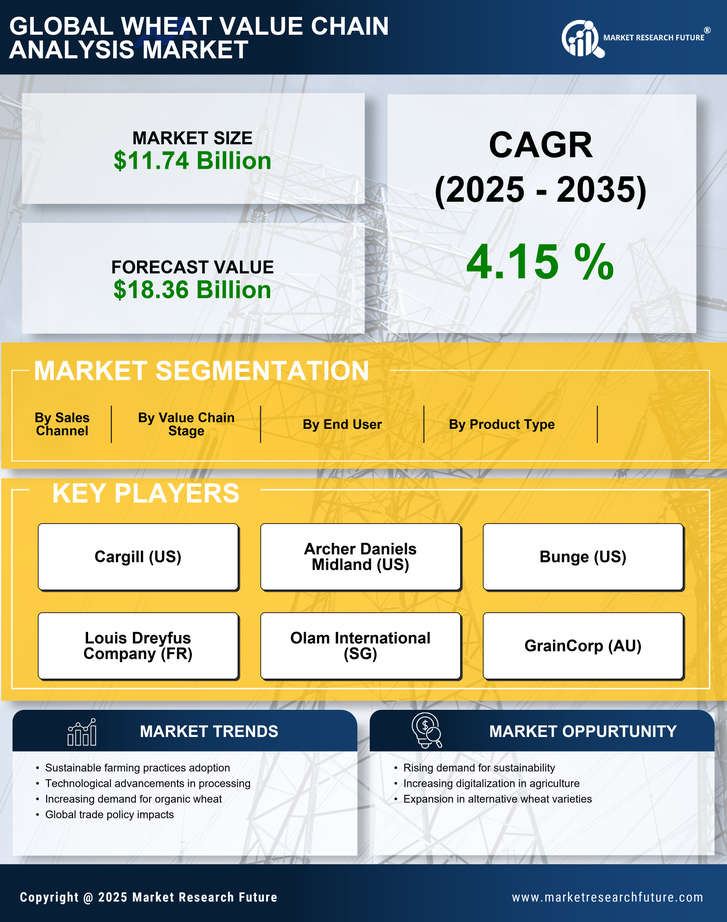

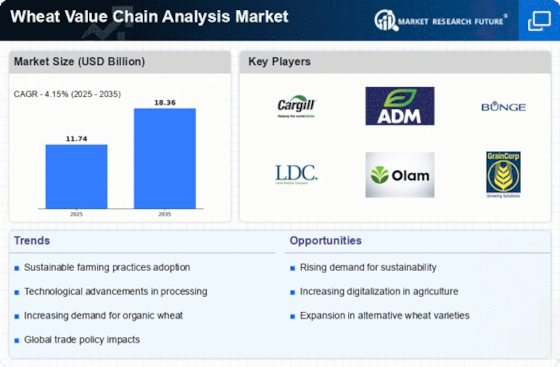

The rising global population and changing dietary preferences are driving an increased demand for wheat products. As consumers shift towards more carbohydrate-rich diets, the Wheat Value Chain Analysis Market is experiencing significant growth. In 2025, wheat consumption is projected to reach approximately 750 million metric tons, reflecting a steady increase from previous years. This surge in demand necessitates a robust value chain to ensure efficient production, processing, and distribution. Consequently, stakeholders within the Wheat Value Chain Analysis Market are compelled to innovate and optimize their operations to meet consumer needs effectively. This trend not only enhances market dynamics but also encourages investments in sustainable practices and technologies, thereby shaping the future landscape of the industry.

Technological Innovations in Agriculture

Technological advancements in agriculture are revolutionizing the Wheat Value Chain Analysis Market. Innovations such as precision farming, biotechnology, and data analytics are enhancing crop yields and reducing resource wastage. For instance, the adoption of precision agriculture techniques has been shown to increase wheat yields by up to 20%, thereby improving profitability for farmers. Furthermore, the integration of digital tools in supply chain management is streamlining operations, reducing costs, and enhancing traceability. As these technologies become more accessible, they are likely to play a pivotal role in shaping the efficiency and sustainability of the Wheat Value Chain Analysis Market. The ongoing investment in research and development is expected to yield further breakthroughs, potentially transforming traditional farming practices.

Rising Awareness of Sustainable Practices

The growing awareness of sustainability among consumers and producers is significantly influencing the Wheat Value Chain Analysis Market. As environmental concerns escalate, there is an increasing demand for sustainably produced wheat. This shift is prompting stakeholders to adopt eco-friendly practices, such as reduced pesticide use and organic farming methods. In 2025, it is estimated that the market for organic wheat products will grow by 15%, reflecting a broader trend towards sustainability in agriculture. This movement not only enhances the reputation of the Wheat Value Chain Analysis Market but also opens new market opportunities. As consumers become more discerning, the emphasis on sustainability is likely to reshape production and marketing strategies across the value chain.